13Jun1:26 pmEST

Precious Screams for Pleasure or Pain

We are not likely to get any type of resolution in the precious metals and mining complex until after the FOMC tomorrow, if at all, to the now-glaring divergence between the weak silver metal versus the suddenly firm junior gold miners.

But you can be sure we will be paying close attention to how the complex reacts to the Fed's decision, statement, forecasts, and presser tomorrow and the reaction into the end of the week.

Since last summer, there has not been much meat on the bone to any type of meaningful swing trades in the precious complex, one reason we have been treading rather carefully in the space across the board.

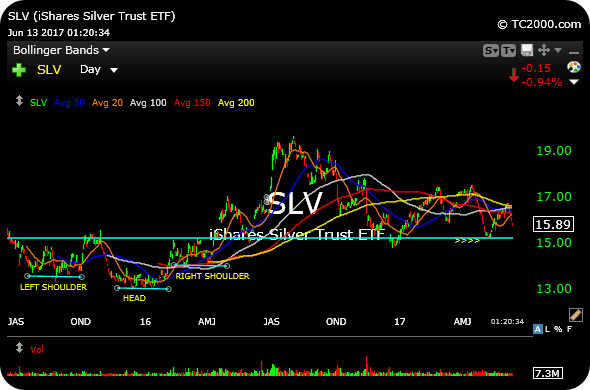

However, the GDXJ (junior gold miner ETF), is now pushing up and off its 50-day moving average, seen on the first daily chart, below, in dark blue. The chart is far from a clean, bullish look. But this strength stands in stark contrast to the silver metal ETF, second below, breaking down below all major moving averages, albeit still above its early-2016 bear market bottom breakout.

Ultimately, one side must prevail here as it is tough to see silver breaking down further and gold miners staging a meaningful breakout. So beyond the day-to-day divergences, we want to see whether the obvious bull or bear arguments handle the Fed and its next policy move/language the best.

More on the market in my usual Midday Video for Members.

Outback: Australian for Rela... Gambling in Front of the FOM...