25Aug11:00 amEST

How the West Was Won

The scenic backdrop of the Jackson Hole Symposium's setting may very well be a pleasant mask of the wishy-washy comments we heard from Janet Yellen this morning. Case in point: Gold, Treasuries, and the major averages are all higher as I write this even as stocks are well off session highs.

Simply put, markets are likely sorting out her commentary and deciding what to do, especially equities after we have seen small caps bounce most of this week. Indeed, the IWM is back up to its 200-day moving average and fading a bit off it as we speak.

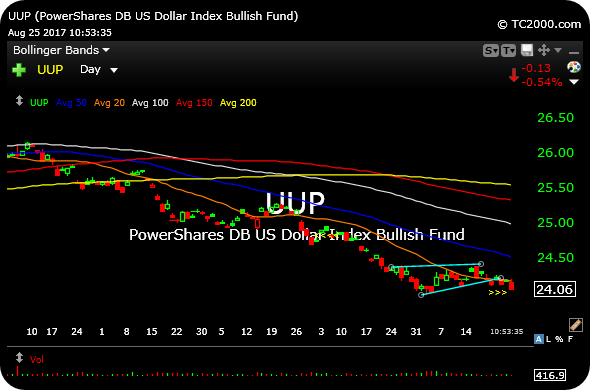

But what seems a bit more concrete is the manner in which precious metals and miners withhold and initial selling attack off the opening bell to bounce back. As it stands now, the weakening U.S. Dollar (UUP ETF daily chart, below) is still giving gold bugs the opening they need to win the battle for a new bull run higher which arguably began back in early-2016.

So while I am not expecting too much from equities into the weekend, a strong close for gold, silver, and their miners would be an excellent long swing setup into Labor Day an perhaps beyond given both the weak Dollar and potential final shakeout this morning.