27Sep1:15 pmEST

Baked in the Healthcare Cake

Small caps continue to dazzle, housed in the IWM ETF for the Russell 2000 Index, as we work our way through the early-afternoon portion of the trading session. While IWM remains extended, as we have seen that has not been a good short trigger at all.

So instead of trying to time an index top, we have been seeking out sector and stock rotations.

One area which essentially corrected most or all of the summer was the group of healthcare growth stocks which had previously flashed rather promising rallies for bulls. Indeed, the likes of VEEV TDOC HQY spearheaded some of the most enticing growth in the sector.

TRHC has been our sleeper play, and that continues to shine, outpacing virtually all peers since August.

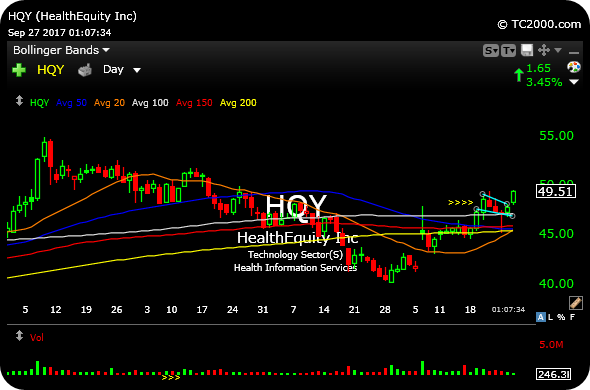

But as far as the more liquid growth names which corrected all summer HealthEquity, below on the daily chart, was astutely flagged to me by a Member this morning.

First and foremost, let us understand and acknowledge that the healthcare gridlock in D.C. may not necessarily be a bad thing for markets. But even if it is, for argument's sake, HQY may have already priced in the bad news with its summer vacation of lower highs and lower lows by price, eventually scalloping out some type of low in late-August.

Thus, markets can often be forward-looking and the quintessential discounting mechanism. And if you accept that theory, HQY may already have baked into its cake all of the healthcare issues befalling America and its politicians.

In other words, HQY may be ripe to emerge from a summer correction to resume its growth run to new highs, now that it is back above all daily chart moving averages and basing well.

More on the market in my usual Midday Video.