18Oct10:44 amEST

The Big Blue Sinkhole Shows Life

The Dow Jones Industrial Average is up by triple digits this morning, even as the Nasdaq Composite Index has intermittently been flashing red since the open. The Dow can thank, in large part, IBM ("Big Blue" as it known), for an earnings rally.

Long-time readers will recall IBM is a name we had consistently been bearish on since around 2013/2014. Recently, though, the name hit its long-term head and shoulders top to the downside and we adopted a more neutral stance.

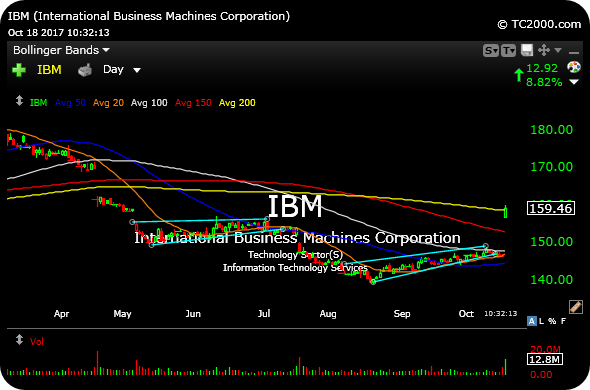

An with today's rally, the daily chart for IBM, below, shows price gapping up to the 200-day moving average, which is still declining.

In other words, IBM is far from out of the wood, technically, on all timeframes.

However, if a long-term turnaround in favor of bulls is to be had, then $160 ought to be the first area reclaimed in the coming days and weeks, coinciding with that 200-day. Simply put, bulls need to avoid seeing sharp rejection at this price area, for it would likely galvanize bears to press under the theory of a fresh leg down after a one-off earnings part.

The other part of this morning's market equation is the mixed action in small caps and tech, which we have seen over the last week or so. These parts of the market have enjoyed strong bull runs, heretofore.

Thus, a consolidation is fine and much-needed. The issue going forward is whether the current action amounts to churning before a major drop, or simply resumption of the prior uptrend. At the moment, I am using strength to lock in some gains here and there.

However, should bears continue to suffer, there seems to be a decent amount of names across a variety of sectors we are tracking for Members which could easily see another push higher before the holidays.

Stock Market Recap 10/17/17 ... Don't Feed HOG to the Hogs, ...