26Oct1:25 pmEST

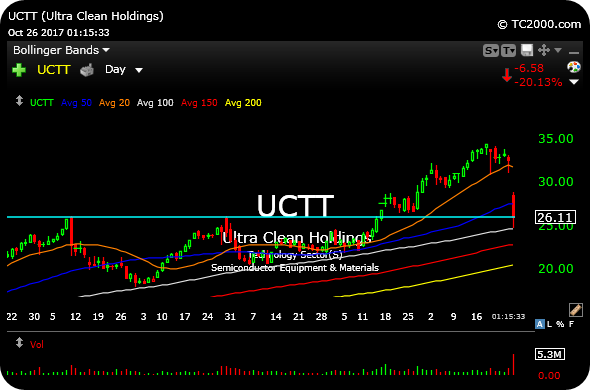

A Sloppy Yet Ultra Clean Chart

Ultra Clean Holdings, Inc. has been one of the more compelling growth plays in the hot semiconductor this year. Despite the sharp price rapidly advancing for much of 2017, the firm's market still never really held above $1 billion.

Despite the growth potential, today's 20% gap down after earnings drives home the risks associated with holding traders through earnings--When it works out well you hear tons of proclamations about how you simply must hold through earnings. But then there are crickets when you see a vicious gap down like UCTT.

To be clear, it is not necessary a Cardinal Sin to hold through earnings as long as one has a well though-out risk management plan. In some cases, that may mean reducing position size before the report. In other cases, it may be hedging a common stock position via options.

Either way, the true mistake is not taking into account the defined risk which earning presents, especially for a small cap, high beta name like UCTT.

Turning to the updated technicals, the daily chart, below, shows UCTT gapping down to prior resistance around the $26 level. Despite how sloppy the move is today, the irony is that the move back down to prior resistance is, in some ways, ultra clean, in terms of now presenting a well-defined area to gauge whether buyers will salvage the earning selloff to stabilize the name anytime soon. I expect we will have a better idea of that answer by early next week.

Elsewhere, the glaring weakness in large cap biotech is a huge drag on the Nasdaq today, namely AMGN CELG, and is once again being masked by some Dow strength.

More in my Midday Video for Members.