08Nov1:31 pmEST

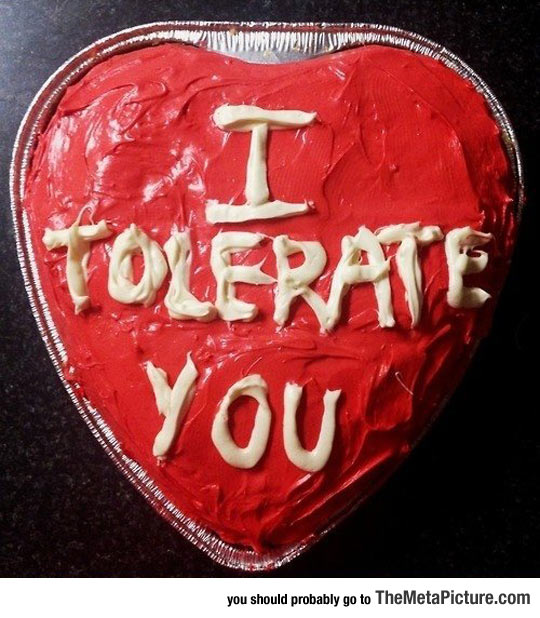

Love Does Not Need to Be Perfect

Just as we do not want to linger too much the likes of SNAP's disaster earnings reaction today and instead focus on peers acting more constructively, namely FB TWTR, we also do want to lament some burger joints getting obliterated after their own reports of late, especially HABT RRGB.

Although it may easy to extrapolate the HABT RRGB blow-ups to virtually all burger chains, the truth of the matter is that Shake Shack is distinguishing itself from its up-and-coming peers.

SHAK also recently reported earnings, on November 1st. In a similar vein to HABT RRGB, SHAK's stock then sold off the next trading session on November 2nd.

However, unlike HABT RRGB, SHAK was able to comfortable stay above its major daily chart moving averages, seen below. Moreover, SHAK then began to settle down from the initial post-earnings volatility and even hold support trend dating back to Labor Day (light blue line).

So while SHAK is clearly far from perfect, a more flexible mindset would recognize the outperformance here. SHAK remains one of the most heavily-shorted stocks in the entire market, gauging the short percentage of its float, and is ripe for a year-end squeeze higher if bulls can reclaim and hold $37 going forward.

More ideas and analysis in my usual Midday Video for Members.

Inspector Garmin: Go Gadget ... Square May Decide if it is H...