09Nov10:40 amEST

Leaves Still on the Trees

With one eye on the lagging small caps in the Russell 2000 Index (not to mention mostly sluggish biotechs, healthcare, transports, and high yield corporate paper of late), we want to stay balanced as long as those parts of the market do not wreck some of the more intriguing, emerging plays of late.

Specifically, the likes of Grubhub Inc., which provides an online and mobile platform for restaurant pick-up and delivery orders. is practically the poster child for disruption in an ever-changing landscape of how consumers (namely Millennials) behave. And the market may not necessarily solely be pricing in how Millennials currently behave, but also may be attempting to discount their behavior over the next several years, to boot.

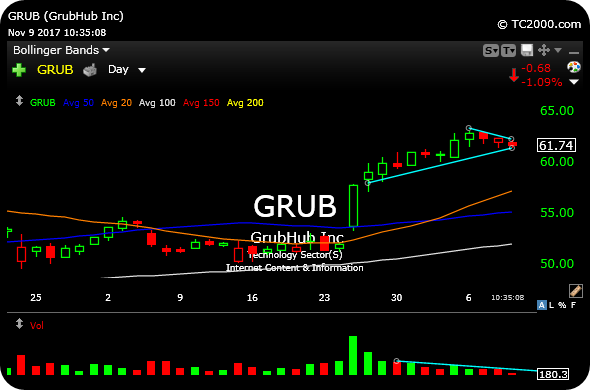

Thus, GRUB seems to be in the sweet spot, as the firm's latest earnings reveals. On the GRUB daily chart, first below, note the steady uptrend followed by an earnings thrust higher. Since then, the last few sessions have seen GRUB rather calmly pullback back with very little in the way of sell volume, just yet. As long as GRUB holds above, say, $60, it is tough to become too bearish on everything even into broad market gaps lower like this morning.

And on the second daily chart, we have a more speculative play due to thinner volume, Tabula Rasa HealthCare, Inc., formerly CareKinesis, Inc.. TRHC is a name we have flagged for Members for a while now as a promising healthcare tech idea, possibly a beneficiary of the omnipresent healthcare debate nationally and, of course, in D.C.. Earnings are out of the way as the chart remains promising for a potential new leg higher over $30.

Overall, the opening gap down on the major indices is short-term concerning, given some weak spots outlined above. However, there are still leaves on the trees in some notable winning names and sectors, too.

Stock Market Recap 11/08/17 ... Junk in the Trunk While Ener...