15Nov10:41 amEST

Back to Salad Days for the Pizza Plays

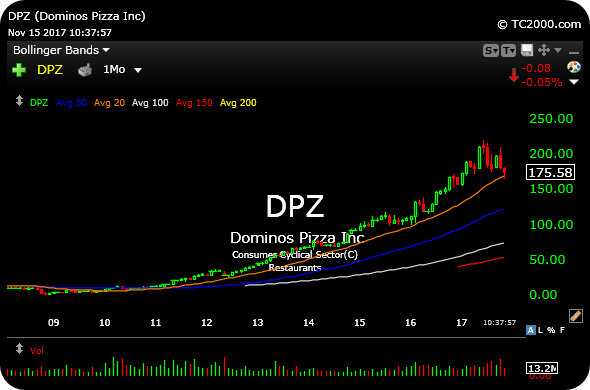

Dominos Pizza, as seen on its multi-year chart (first below), has actually been one of the big winners since the 2008/2009 bear market bottom. Last decade, DPZ had some ugly incidents at its franchises and was generally viewed as having a comically bad, albeit cheap, product. The firm made a valiant effort to turn its brand around right near the bear market lows, and benefitted from a new bull run, a very accommodating Fed, and low-to-mid class families able to feed everyone at a cheap price with a somewhat improved brand and product line.

However, both DPZ and Papa Johns (PZZA, third daily chart) are not looking well on their daily charts (DPZ daily is second below). They both look like bear flags here as the pizza trade unwinds a bit after a multi-year bull run, and stronger emphasis on burger chains like SHAK emerging.

Moreover, Papa Murphy's, (FRSH, fourth chart below on daily timeframe) owner of the Take 'N' Bake pizza chain, may be about to disrupt the industry. The chart looks much better than DPZ PZZA of late, albeit with very thing average daily volume, which is a concern to trade.

Nonetheless, DPZ PZZA look more like shorts than longs, even if you pass on the FRSH idea.

As for the broad market, oversold small caps likely hold the key as to whether bulls find the stones to step in and spark a pre-Thanksgiving rally. The action does not look too bloody at the moment, with standouts like ROKU green and trying to flag out after its jaw-dropping rally.