20Dec2:32 pmEST

Under the Cover of Cryptomania...

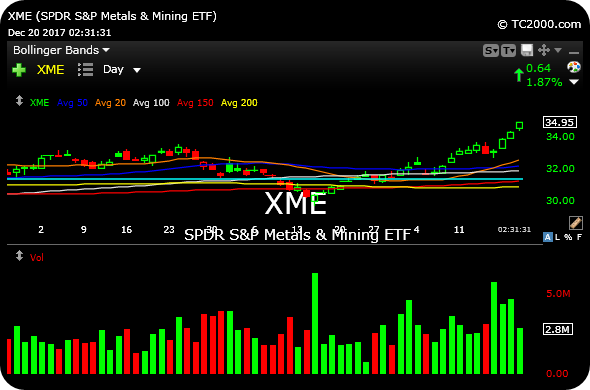

Lost in the shuffle of the focus on crypto plays of late may very well be the surge in materials. The XME, sector ETF for materials miners, non-precious and a few precious, as well, can be seen below on its daily timeframe.

The heavy and steady buy volume (bottom pane of chart, with a barrage of sizable green daily volume bars), indicates that over the last month we have seen buyers of notable size establishing positions in the miners. Note that this also includes steel plays, which are surging today in lockstep with the XME.

At a minimum, these types of moves represent a rotation down to value, as materials and now even energy are finally acting more constructively after years of lagging tech, for example. Similar comments apply to the recent uptick in retail names.

Beyond that, a more bullish take beyond a mere near-term value rotation would be that the market is attempting to front-run an uptick in inflation into 2018, which means miners are set to potentially explode higher and actually take over the leadership reigns of the entire tape.

While that ambitious thesis remains to be seen, it is worth remembering the bigger picture: Virtually all miners remain well above their January 2016 lows, which still could easily mark the seminal turning point of the prior commodity bear market. If so, a new bull run is barely just beginning and has a long way to go. What makes this scenario even more bullish is the distraction that crypto is providing, which ought to be bullish in terms of keeping sentiment under wraps from a contrarian perspective.

At the moment, we are looking to see if sector laggards like CLF play catch-up to the materials running across the board.

Morning Prep 12/20/17 {Video... Stock Market Recap 12/20/17 ...