02Feb10:34 amEST

Bears Must Take Away the Bulls' Most Powerful Offensive Weapon

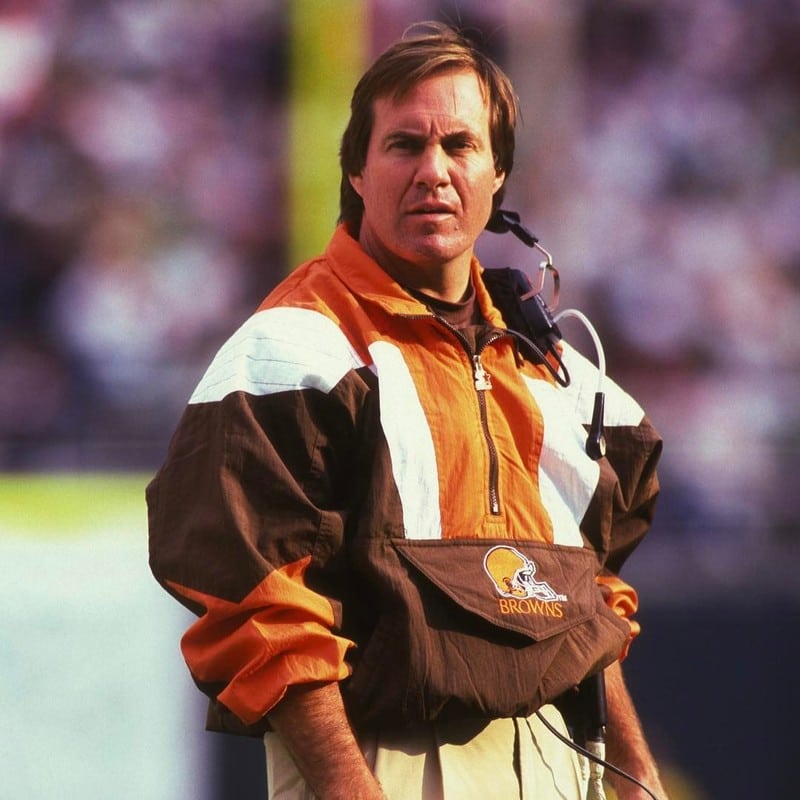

Bill Belichick (pictured above when he was head coach of the Cleveland Browns in the 1990s) will try to win his sixth Super Bowl this Sunday evening in Minnesota as head coach of the New England Patriots against the Philadelphia Eagles.

Belichick is, specifically, known for his astute defensive schemes and game plans tailored to a given opponent. In particular, he first and foremost center his scheme around taking away the opposing offense's best and then second-best players. Once he does that, the rest of his defense can often contain the offense's third and fourth options.

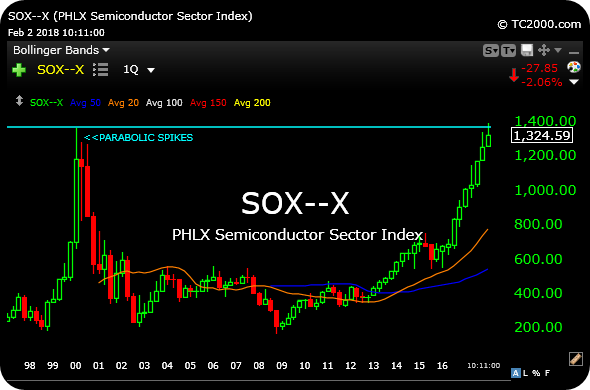

When we look at the stock market over a period of years, there is little doubt that the semiconductors have been as strong as any group in the tape. Clearly, the chips have been, at various intervals, either the top or top two weapons of the bulls, and the NVDA explosion beginning in late-2015 only added fuel to the fire.

Now, however, comes a golden opportunity for bears, since the bull run in equities has surpasses expectation for just about everyone, myself included.

Case in point: The SOX (Philadelphia Semiconductor Index) multi-decade chart, below, shows us a virtual straight-line rally back to the proverbial scene of the crime in the form of the dot-com bubble highs--You can see the panic buying, parabolic spikes we saw in late-1999/early-2000 before the abrupt reversal and crash.

The concept of "overhead supply" has understandably received its fair share of critics in recent years, which will always be the case as it is the nature of the beast in a one-way bull market. Seemingly unending bull markets cultivate a certain arrogance and hubris among many market players which you can likely see for yourself on a daily basis on social and financial news media, for example.

Still, it is much more likely than not that we now see chips go sideways or down in the coming weeks and perhaps months in lieu of continuing to move higher. Those prior bubble highs are, even in this bull run, more likely than not to assert themselves as a ghost from the past.

As we saw with QCOM last year, however, shorting individual chips can be ominous given the risk of M&A even for mega cap firms. Thus, shorting the SMH sector ETF outright makes more sense, or using SOXS as a levered bear ETF for aggressive traders.

Of course, that assumes bears will be able to execute a Belichick-esque game plan, which is asking for a lot considering they have performed more like the current day Cleveland Browns than anything else. Markets always work in cycles, though. So, I want to take my cues off the chips now to see if these major prior highs become more significant as resistance.

Stock Market Recap 02/01/18 ... It's Adult Swim Now, Act Acc...