06Feb10:38 amEST

Fully Hedged and Full of Bovine Scatology

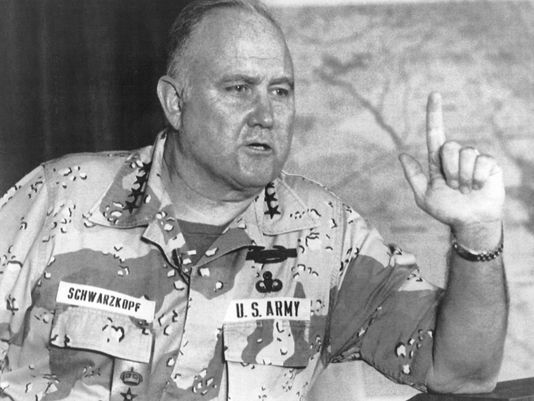

General Norman Schwarzkopf, pictured above, once scoffed at a report critical of him during the first Gulf War as, "...bovine scatology."

When we look at what has happened with the deeply-flawed volatility (VIX)-related ETFs and ETNs over the last eighteen hours or so, namely SVXY and XIV, something else stinks to high heaven.

On the one hand, we know virtually all ETFs and ETNs are trading vehicles only, a concept we have been preaching for years now. But on the other hand, it is always breathtaking to see such a swift move, especially after hours last night in SVXY XIV, which only serves to breach any notion of trust between the vague phrase, "Main Street" (here: retail traders and casual market observers) and Wall Street.

XIV is now set to be terminated (or "accelerated," en parlance at Credit Suisse, the firm behind XIV, or VelocityShares™ Daily Inverse VIX Short Term ETNs), on February 21, 2018. CS claimed overnight that they were fully hedged on the XIV exposure, which is an interesting statement to say the least when you consider counter-party risk.

In fact, the very phrase "fully hedged," may become this cycles version of "subprime is contained," if we see more ETFs and ETNs suffer similar fates.

Regarding equities, an opening bounce was initially stuffed, though we may simply be sloshing around down at these levels looking for a near-term reason to stage a bit stronger of a bounce. I see several online brokers are having technical issues this morning, which could also be impacting liquidity and exacerbating some of these price swings.

For now, I am looking to be tactical in terms of reducing my short exposure into further downswings, and am not quite ready to step back in on the longs side.

Stock Market Recap 02/05/18 ... Sneaky Retail Smarts on The ...