07Feb1:09 pmEST

Be Careful Who You Trust

The many, powerful "V-shaped" rallies bulls have enjoyed over the years likely convinced traders who never traded prior market cycles that the V-rallies were entirely normal. On same level, that is true. But there are many other instances even in bull runs where corrections take a bit more time and pain to play out before the bull market is ready to resume (putting to one side here the topic of whether the current bull run has topped out).

On that note, the 200-300 points rally in the Dow today may be masking a part of the market which arguably led us lower: The small cap stocks housed in the Russell 2000 Index.

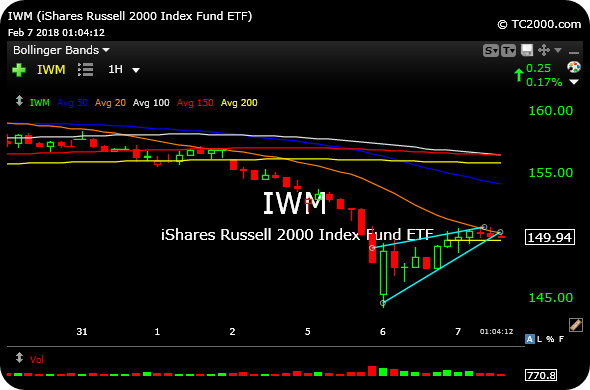

Using the Russell actively-traded ETF, IWM, as a proxy, the hourly chart, below, shows us reasons to not yet become too aggressive on the long side.

As you can see, the bounce off yesterday morning's lows may simple be a bear flag to set up the next leg down.

We were previously short the IWM, and may very well reenter if bulls cannot put together a more convincing bounce this afternoon, despite some bright spots like SNAP TSLA WTW.

Thus, we need to be careful which index we trust most during these bounce attempts.

More in my usual Midday Video for Members.