09Feb10:34 amEST

A Shady Throwback

Although FEYE and NVDA are two bright spots for bulls on the earnings front today, with both names gapping higher this morning, the broad market bounce attempt has yet to make much of a dent vis-à-vis yesterday's 1,000-point plunge on the Dow.

To be sure, an afternoon squeeze may gather steam if bears are unable to overturn the rally and decide not to press their shorts into the weekend. Then again, one must wonder how many longs truly want to hold their positions over the weekend, too, given the sudden uptick in fear and market dislocations we saw this week regarding SVXY and XIV.

As always inside the service we are putting in our due diligence to track relative strength names for Members, in the event the market does quickly firm up next week and turn back higher.

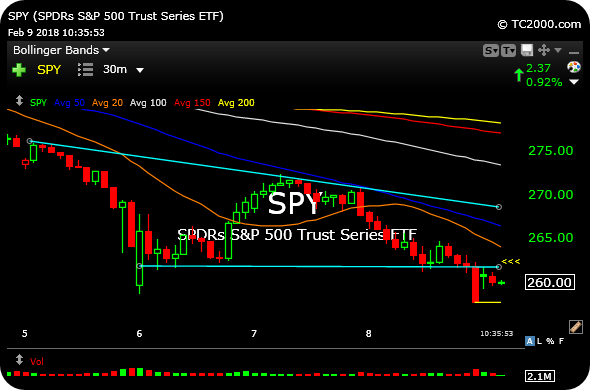

But in terms of the current technicals, a good perspective is the SPY (ETF for the S&P 500 Index), below on the 30-minute timeframe.

After an ugly close yesterday (note the sizable, red candle capturing the final thirty minutes of yesterday's session, knifing to the lows into the bell), we gapped higher this morning.

However, that gap higher merely served as a technical "throw-back, or check-back, or retrace up to the scene of the highlighted (in light blue) broken triangle support.

That broken support equates to roughly $261.50/$261.60, which incidentally served as resistance off the initial catapult higher this morning. As we speak, we continue to fade off that throwback, rendering the gap up a bit shady now, especially if bears take this market back into the red on a Friday of a wild week.

Either way, we now have some defined context off of which to key the rest of the session for some intraday technical perspective.

Stock Market Recap 02/08/18 ... Cold, Hard, American 100% C(...