02Mar10:48 amEST

A Smoot Point Over the Long Hawley

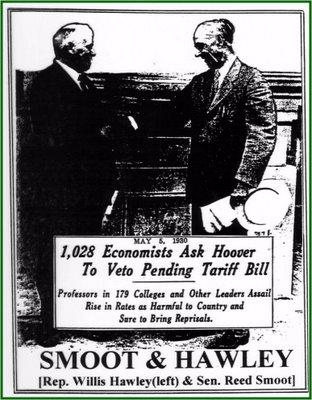

The protectionist tone and measures by President Trump and his Administration is understandably conjuring images from the 1930s of the Smoot–Hawley Tariff Act and subsequent fallout. Back then, the overriding intention of the Bill was to protect U.S. farmers against agricultural imports. However, the Smoot-Hawley Tariff Act wound up escalating a global trade war amid a fragile economy.

Of course, that historic interpretation is up for debate. But the market may be a bit spooked by history "rhyming," even if it does not repeat.

Also note steel stocks like AKS X giving back yesterday's gains, as are domestic aluminum names, which may be a good indication of a sell-the-news reaction.

Either way, the main technical for markets today is avoiding a further slide below 2,650 into the weekend on the S&P 500 Index. If we do slide into close, I suspect many a long will endue a panic-filled weekend regarding a test or breach of the early-February lows, thus creating a self-fulfilling prophecy whereby the selling escalates further early next week.

We also have our eyes on the U.S. Dollar, backing off a bit today after a strong bounce. Gold and her miners are trying to bounce right where they need to, and a few outperforming gold miners are certainly on my long radar now.

Stock Market Recap 03/01/18 ... How Aggressively Will You Pl...