07Mar10:24 amEST

A Lesson from the Preppies

It may seem a bit surreal that the seemingly-obsolete Abercrombie & Fitch retail brand is on the comeback trail, as their coolness factor seemed to peak sometime in the late-1990s. Nonetheless, like plenty of other retail and consumer brands seemingly left for vultures to encircle, ANF has made a valiant effort to improve its technical situation a good deal tn recent months.

And after a strong earnings quarterly report this morning, shares of ANF are higher by more than 10% amid a soft overall tape still reeling from the Cohn resignation last evening.

But even if you have no interest in trading ANF, an important technical lesson is revealing itself.

It may seem like a rather simple concept, and it is. However, it is worth driving home that the shorter-term timeframes on a chart eventually comprise, in aggregate, the longer-term timeframes.

Applied to ANF, the first daily chart, below, shows us a picture-perfect chart for bulls with price basing quietly in an uptrend before earnings. After earnings, as we know now, the stock is surging higher yet.

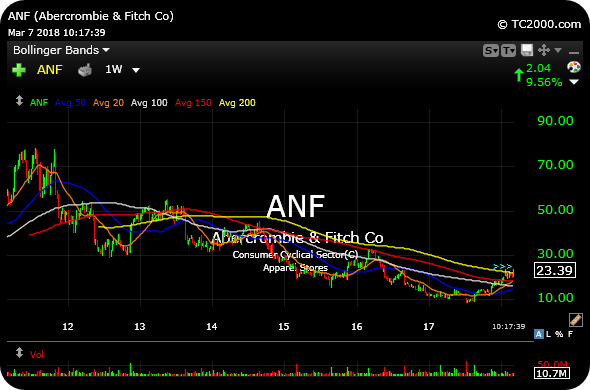

The monthly chart, second below, shows us the extent of the dark period for retail. Since 2011, simply put, Abercrombie & Fitch had been a terrible performer. In fact, you would not have caused much of a stir in predicting the stock eventually going to zero.

However, despite the long-term downtrend still apparently intact, we can see price now peeking its head over the 200-period monthly moving average (yellow line on second chart), something not seen since a failed bounce in 2014.

ANF may very well in the midst of another failed bounce here, but the important lesson is that the daily chart is growing stronger, not weaker. And as long as that continues to be the case we could easily have a long-term turnaround on our hands of the bullish variety--After all, in failed bounces amid bear markets we often seen major events for a firm like earnings serve as both the excuse and catalyst to resume the downtrend which, as we know, is not the case for ANF here.

Going forward, any dips or pauses which hold over $22 has my interest on the long side.

Stock Market Recap 03/06/18 ... Kroger is on the Verge of Be...