13Mar10:32 amEST

Stare at Pinched Lululemons Without Getting Caught

After lagging yesterday's tape, several quality intermediate-term chart setups for longs in the retail space are bouncing back this morning. Specifically, the likes of ANF CROX LULU SKX seem to merit our attention if they resume their prior uptrends anytime soon.

LULU, with earnings in a few weeks on April 4th, remains in play from a variety of angles, be it the buyout gambit which has been speculated for quite some time, or a more meat-and-potatoes angle which would be a sound technical picture.

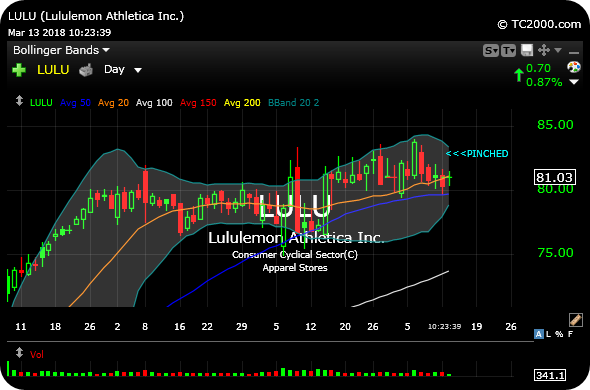

On the LULU daily chart, below, we can see price still operating in a smooth uptrend, with price above rising and smartly-aligned major moving averages. Indeed, LULU suffered virtually no damage during the market volatility surge earlier this winter.

Beyond that, price has quickly tightened back up after any and all spurts of indecision, to the point where LULU's daily Bollinger Bands are effective "pinching" in.

Concocted by John Bollinger, his eponymous indicator tells us currently that LULU's pinched Bands mean that price has become rather compressed to the point where we should now be on watch for imminent directional resolution--After all, a stalemate can only last so long before buyers or sellers eventually prevail. And given the overall chart setup, bulls get the edge albeit with earnings a looming risk.

In other words, I am looking at LULU as a swing long setup over $82.

Elsewhere, we have some decent market action again this morning for bulls. However, it is important to be cognizant of the fact that both leader AMZN and now the small caps in IWM are extremely extended short-term and could easily see a quick shakeout or two to keep bulls from falling asleep at the the week.

Stock Market Recap 03/12/18 ... Tough Resistance After a Str...