08May10:55 amEST

Another Scavenger Hunt of Sorts

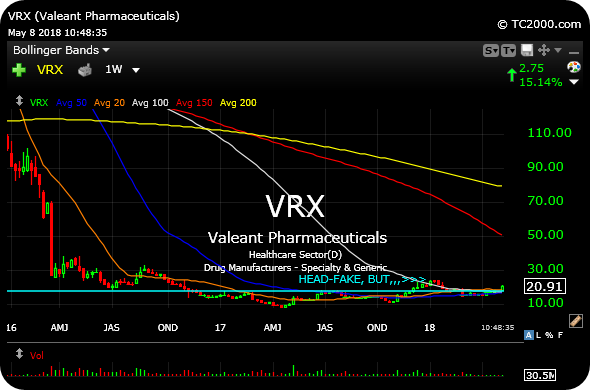

Valeant is up nicely after earnings this morning, a name which is practically infamous at this point given that it was the scene of one of Bill Ackman's biggest losses when he realized his mistake both in literal (selling out of his position) and figurative terms, acknowledging his stubbornness during VRX's devastating, unforgiving downtrend from 2015 into 2016.

Since then, however, we must seriously ponder the question whether VRX is actually forming, and has been cultivating indeed, a massive bathtub bottoming pattern in lieu of setting up to go to zero or perhaps remain "dead money" for the rest of this decade at least.

The really into the beginning of 2018 was promising but then fizzled out, forcing me to take it off my radar when at one point I was considering a long.

Now, however, with the earnings rally today I am compelled to put VRX back on long radar as some type of scavenger hunt play, given how downtrodden the chart remains on a long-term basis. Nonetheless, VRX beat revenues and raised guidance, and the daily chart is not nearly as ugly as the zoomed-out weekly is, below.

Hence, I view one-to-three day pauses or dips now as spots to more seriously VRX as a long candidate headed into the summer months.

Valeant also has all the sentiment hallmarks of being at an inflection point, with the publicity of Ackman long gone, as is his position. It is very likely that longs form 2015 have already been washed out, as the stock has slipped into oblivion over the last few quarters.

In sum, Janaury's head-fake was disappointing but could just as easily be part and parcel of a long-term VRX bottom.

Stock Market Recap 05/07/18 ... When the Going Gets Tough, t...