17May10:41 amEST

Playing a Little Red Store By the Little Red Book

China earnings plays this morning are a push, with BZUN up nicely but NTES getting crushed. We know BABA and BIDU have been rather impressive lately, while SINA WB have slumped.

One play which seems to be overlooked these days is yum China, the China spinoff of YUM, home to fast food iconic brands like KFC, Taco Bell, even Pizza Hut.

YUMC is largely centered around KFC, a wildly popular brand in China, as well as Little Sheep.

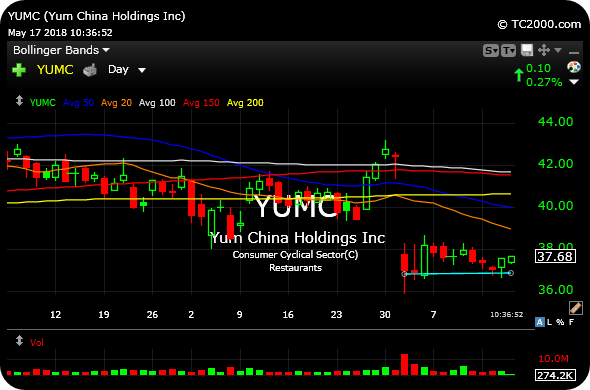

Either way, with restaurant plays coming alive this spring it is worth a gander to see if YUMC can hold recent support on its daily chart, below.

On some level, this is a fairly "easy" trade setup, not because profits are guaranteed, or anything close to it. In fact, the YUMC chart remains generally sloppy, below criss-crossing long-term moving averages which hover above.

Instead, the appeal of this type of setup is that we have an easy stop-loss below to define and adjust our risk/reward ratio. A move below $37 on a daily closing basis takes us out of any longs, while we can target the 200-day simple moving average, nearly up to $41.

Also note that if you view YUMC on longer-term timeframes, the $37 level marks a significant prior price area. So, bulls have a few factors in their favor here to give support a chance.

Stock Market Recap 05/16/18 ... Sex Appeal Comes Naturally f...