19Jun10:53 amEST

Unexploded Trade War Bombs

Equities have largely been able to cast aside the barrage of trade war headlines in Trump's first term in office. China has often been on the business (er, political) end of the trade war news, as the headlines often cross in the evening hours. Although the initial jolt of seeing the headlines has been significant at times, or at least felt like an important development, equities, again, have most taken the news in stride.

This morning's gap in the broad market is a bit heavier than what we have seen of late, though, as Trump ramped up his rhetoric and plans to slap tariffs on another $200 billion worth of goods from China.

At first blush, the move in equities seems like an overdue price pullback in lieu of simply seeing the indices mark time mostly sideways. Some high beta names like SNAP are getting noticeably hit harder than usual, with a Cowen downgrade not helping the cause for longs, either.

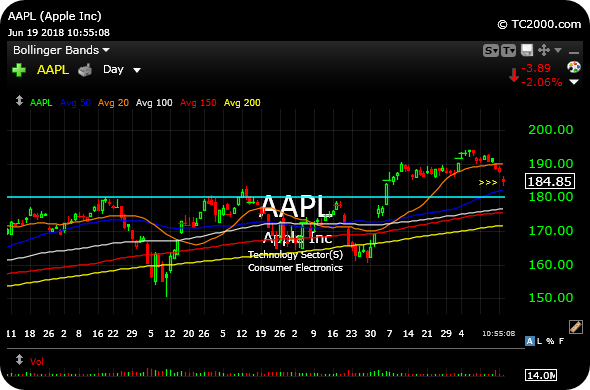

But the main point to keep in mind is that context and location of many charts. A monster leader like Apple, for example, is on track to test its 50-day simple moving average (dark blue line on AAPL daily chart, below) for the first time in seven weeks or so. Also note AAPL remains comfortably above its prior breakout area (light blue line) from earlier this year.

In other words, AAPL has suffered no real damage yet.

With this in mind, plus some intriguing standouts today like SRPT on positive news as well as some bright spots in biotech, we do not want to throw in the towel on the overall bull case just yet. The trade war headlines may seem like ticking time bombs for markets, but in many cases they go unexploded, too.