26Jun10:44 amEST

Small Caps Must Avoid a Waterloo Moment

Unlike the way in which the diminutive brilliant military strategist Napoleon was defeated at Waterloo in Belgium by the Duke of Wellington, the mighty small caps in the Russell 2000 Index still have a chance to sidestep a possible game-changing defeat at the hands of the bears.

For a while now, the small caps have thrived, easily one of the strongest parts of the market and, at times, leading the charge higher even when bears felt they had bulls cornered based on news headlines, negative divergences, seasonality, etc..

But this time around the stakes seem to be higher, as not only banks have recently unwound sharply but we also have large cap tech coming in too.

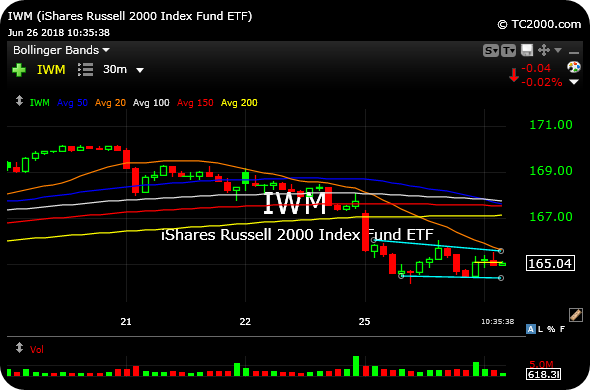

On the 30-minute chart for the IWM, which is the actively-traded ETF for the Russell, we can see those small caps trying to stabilize around the $165 area this morning after pulling back around the middle of last week.

But the bear interpretation of this pattern, highlighted in light blue, would be one of a bear pennant consolidation which is bound to resolve sharply lower, surely part of a Waterloo moment for small caps.

As I write this, I see that bulls are putting up some type of fight at $165. However, if they fail here I suspect we are due for a fast leg lower not just in the small caps but the broad market, too, as dip-buyers will realize they have been taken and are likely to hit the exits quickly.

If you want to feel a bit more sanguine, note retail play FIVE (Five Below) continues to shine and is not flinching whatsoever into this market pullback, green again this morning and looking brilliant on all timeframes as an emerging retail growth leader.

Stock Market Recap 06/25/18 ... Tesla Shock Therapy in Effec...