20Jul10:58 amEST

Anyone Up for a Quick Trip to Brazil?

At various times it can seem as though the visible emerging markets, namely the "BRIC" countries of Brazil, Russia, India, and China, can often be attached at the hip to gold. After all, if the U.S. Dollar is rising, as it has of late, then gold often slumps as do most commodities. And, oftentimes in sympathy, emerging markets are struggling, too.

But even with gold bears out in full force this week, we saw a similar sentiment regarding emerging markets insofar as many market pundits "calling out" those who forecasted a bullish 2018 for the BRIC economies.

I have not had a horse in this race per se, apart from a few sporadic and, ultimately, quick shots at precious miners this year.

However, with the U.S. Dollar (UUP ETF as just one rough proxy) gapping down today after a multi-week grind higher, emerging markets have my attention on the long side for the first time in a while.

Generally speaking, contrarian trades are lower probability setups, practically by definition, as you are typically fighting a well-established trend and presupposing that your knowledge of prevailing market sentiment is accurate.

Thus, the contrarian trade should be reserved for a special situation, one where factors like fund managers' positioning is remarkably low, as @ukarlewitz notes here.

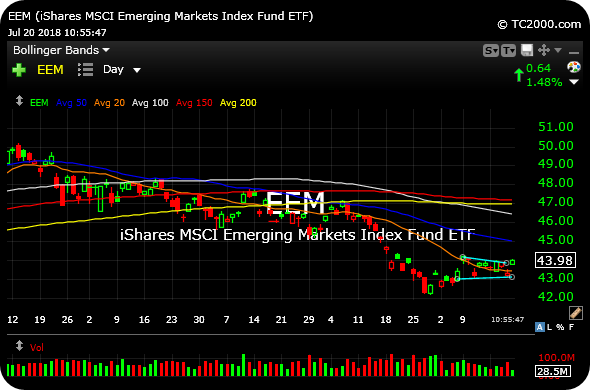

From my vantage point, what adds credence to the bull thesis for emerging markets would be technicals aligning with this view. On the EEM ETF daily chart, first below, the ETF for the BRIC countries is holding its 20-day moving average and possibly putting in a temporary higher low versus its late-June lows.

The second chart shows EPI, an ETF for India on the monthly timeframe. For a while now, India has had the stronger country ETF chart than Brazil, China, and Russia.

Note EPI merely pulled back to its 20-period monthly moving average (orange line) and held its prior 2015 highs (light blue line), indicating that no long-term damage has really been done despite the BRIC's decline this year. MMYT is India's version of BKNG (Priceline), basically, and presents one of the better emerging market long setups.

On that note, some individual Brazil stocks could be in the sweet spot if the Dollar keeps coming in and emerging markets keep rallying: The two main Brazil steel stocks, GGB and SID.

Stock Market Recap 07/19/18 ... Sunday Matinée at Market Ch...