15Aug3:20 pmEST

Time to Go Underwater Fishing?

The persistent strength in the U.S. Dollar has generally impeded most rally attempts by the material and mining complex of late. But precious metals and miners, in particular, seem to have been impacted the most. And, now, for all intents and purposes the sector is diving at an alarming rate.

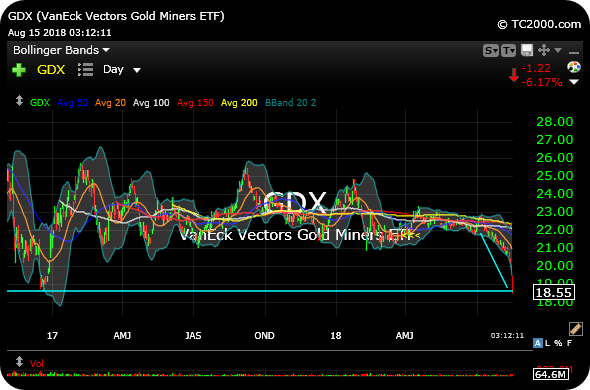

At issue for us is whether the selling is simply overdone. Gauging the GDX daily chart, below, which is the ETF for senior gold miners, the easiest answer is to look left and see price suddenly back down to the late-2016 lows, where buyers were willing to step in. Thus, extrapolating the same here makes sense. In the near-term, though, I think that answer may be too easy, as downside momentum in the metals and miners is notoriously dangerous and ferocious.

But I do suspect that further swoons from here on out will be good spots to carefully test out some toes in the long water, especially with the notable change in the angle of descent.

Specifically, over the last week or so the bottom fell out of the GDX chart with price going darn near vertical to the downside. That type of occurrence is consistent with panic selling much more than orderly bearish action.

But, again, another thrust lower or two would make the most sense here before a more screaming "buy the blood" scenario materializes, not to mention seeing the Dollar back off for more than a few hours.

More Combat in Close Quarter... Stock Market Recap 08/15/18 ...