24Sep2:10 pmEST

Pot Stocks Might Be Gearing Up for Another Special Move

The easiest thing in the world for most traders right now would be to assume that the "easy money" in the marijuana trade has already been made, and that buying pot stocks here is tantamount to buying Bitcoin last Christmas. To be sure, the price swings we saw in TLRY last week ought to given even the most hardened speculator pause, in terms of how much capital one can allocate to these high beta names and still sleep at night.

But the fact remains that an objective scan of some of the MJ holdings (sector ETF for pot-related names) reveals we have a benign consolidation (relatively speaking) underway which could easily be setting the group up for another push higher.

Sentiment-wise, there not seems to be a fair amount of healthy skeptics regarding anything pot-related, but there are also plenty of headlines to distract market players from them this week, including trade wars, White House staff changes, FOMC and rates in general, GDP, seasonal market weakness, not to mention end of quarter trading.

All of those factors may impede the type of euphoria which we saw in Bitcoin and crypto last December because that complex unraveled.

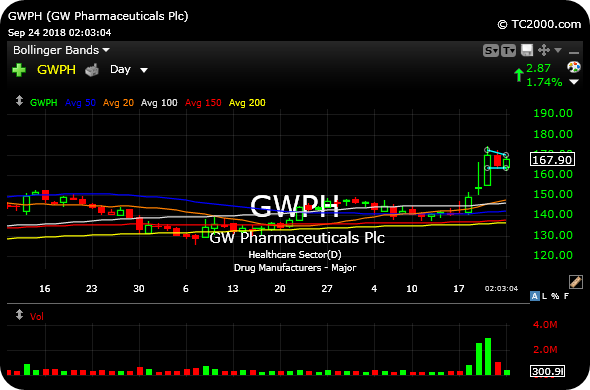

To make things more tangible for you, though, consider how well GWPH is digesting its recent gains. We sold a GWPH long into strength inside Market Chess Subscription Services within the last week. But you can be sure this type of action, alongside the tight bases in CGC INSY, are keeping me particularly interested in reentering the pot trade for another move higher.

DNR Also Stands for Do Not R... Stock Market Recap 09/24/18 ...