27Oct2:49 pmEST

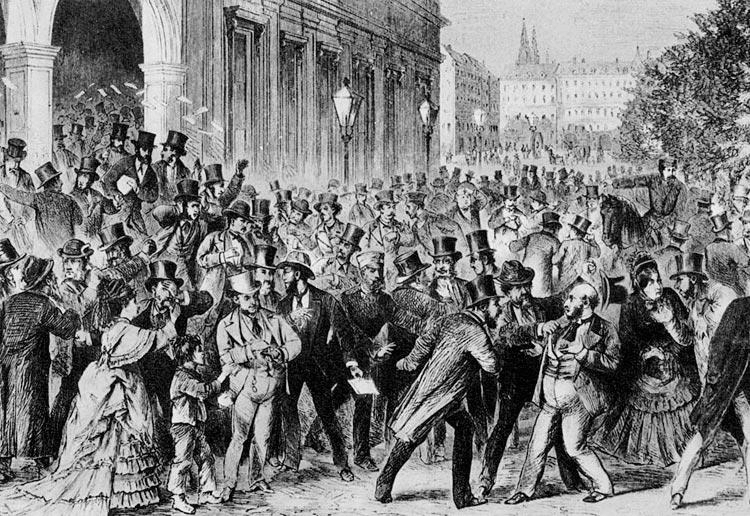

The Panic of 1893

Consistent with human nature, when the market is in a smooth uptrend we tend to view historical crashes and depressions (or "Panics," as they were once known) as nearly-comical events of Wall Street yesteryear. The emotional disconnect to a bonafide crash and depression (let alone bear market or recession) is so wide during a present day bull market as to barely be recognizable as something that can actually happen again anytime soon.

Thus, it is only when the market finally corrects that we begin to see interest in historical market anomalies perk up which, again, is consistent with human nature.

We all know about the 1929, 1987, even 2008 crashes by now, in some way shape or form. They still merit a review every now and then.

But lest we forget other devastating events like The Panic of 1893, for example.

In the following video, which is well worth a weekend viewing, Lawrence Reed, President of the Foundation for Economic Education, lectured at the Freedom University: Austrian Economics Summer Seminar and discusses the Panic of 1893.

There's Being Bullish; And T... Weekend Overview and Analysi...