05Nov3:05 pmEST

The Duck, I Says

Even with rates going higher and The Fed on track to raise at least once more before 2018 is over (likely in December), it is fascinating to see those sectors which one would think should suffer from higher rates flourish of late.

Specifically, the high-yielding consumer staples, REITs, and utilities have functioned as impressive safety trades amid some violent unwinding in tech and other parts of the market since late-September. We know names like MCD and WMT have done well.

But seeing the likes of CHD and HRL get into the act, among many others in the IYR XLP and XLU sector ETFs presents a dilemma of sorts--On the one hand, we want to go with the flow with capital rotations. But on the other hand it is not exactly inspiring for the bull case to see such stodgy, slow growth names take the lead while the tech stalwarts fail to largely hold bounces.

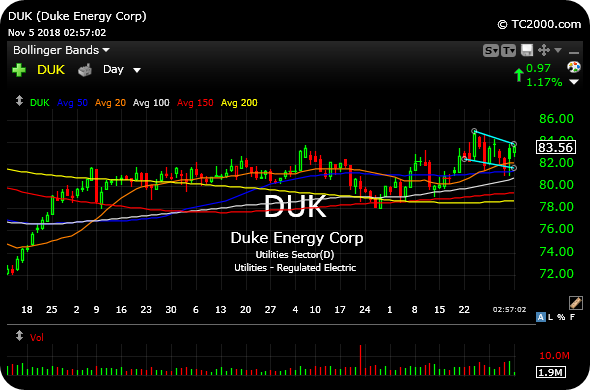

Another textbook example of the relative and absolute strength in the above-named sectors is Duke Energy (or "The Duck," if you will), below on the daily chart looking far more impressive for a swing long setup than any "FANG" and just about all tech stocks at-large.

Again, natural gas and Brazil seem like special situations. And the uranium strength is almost always a special case anyway.

So as far as the tape goes, headed into the midterm elections it is hard to make a strong bull case as far as the high-flying tech stars of recent years. However, if you are willing to be unforgiven as a momentum trader, some defensive stocks such as DUK look like they could continue be decent hideouts until further notice.