24Apr10:55 amEST

From Prey to Predator

We have a mixed morning so far, with the indices lurching just above and just below the flat-line as I write this.

However, it is worth noting that the Russell 2000 Index's small caps are outpacing just about all other indices. Recall that this strength comes on the back of yesterday's powerful rally, which was the first time a good while we could say as much about the lagging small caps.

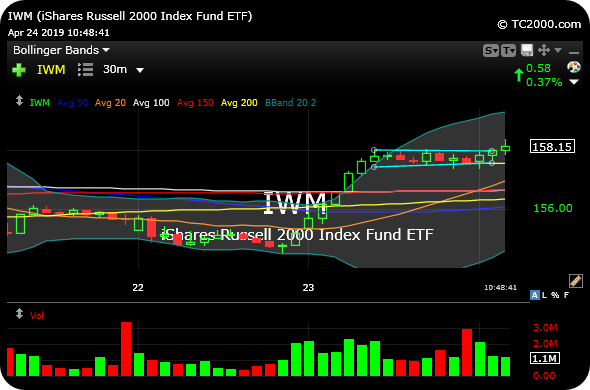

Moreover, the IWM (ETF for the Russell) is acting well this morning despite a heavy sell program in the small cap biotechs (XBI ETF) hitting them off the opening bell. The 30-minute chart for both the IWM and XBI, respectively below, illustrates each point. As we know, there is plenty of overlap between the XBI and IWM, making this relationship all the more important when we see divergences.

Thus, if the small caps as a whole can continue to flex on the back of yesterday's rally in addition to biotechs backing and filling, I view it as a particularly bullish development for the market regarding rotations.

As for the IWM's next technical hurdle, $159.50, just above, likely sets in motion a larger breakout now that bulls are fighting to hold us back above the 200-day moving average.