14May10:47 amEST

Get Those Flags Right

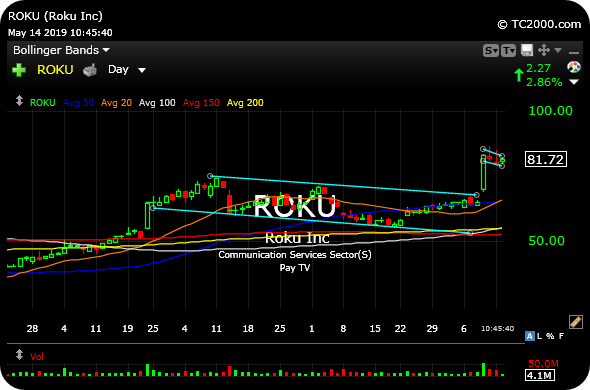

Roku, below on its updated daily chart, has been one of the more notable outperforming charts during this market mess of late. As you can plainly see, ROKU knocked the cover off the ball with its recent earnings report and has subsequently barely flinched.

ROKU is currently sporting a variation of a high, tight bull flag look, which simply means that the stock is readily digesting its massive gains with little in the way of actually selling yet. We saw similar action in small cap security play ZIXI a week or so ago, too.

However, it is worth noting a point we often make with Members that most stocks will tend to move in sympathy with the character of the broad market at a given juncture.

Hence, the high, tight bull flag setup, as attractive as it may be, works best when we are in a silky smooth market uptrend with minimal volatility.

As we know, the current market has been far more headline-sensitive than usual, prone to abrupt gaps and plenty of swing which put even the most enticing of individual long setups on hold, at least for now. Again, that can change quickly if and when the headline-sensitive abates (even if the headlines themselves do not).

But this morning's bounce in the market is likely insufficient evidence to conclude the volatility is fully behind us. Thus, as attractive as ROKU is here, one needs to temper the bull thesis with the knowledge that the broad market may keep a lid on those bull flags.

That said, ROKU, in and of itself with its impressive growth and execution, continues to be the poster child for relative strength and stands to fare quite well if and when we emerge into a new, smooth, market uptrend.