19Jun3:13 pmEST

You Are Now Free to Move About the Hamptons

Working our way through the final hour of this Fed Day, it appears Fed Chair Powell has, at least initially, done enough to soothe markets despite not giving equities a rate cut. Overall, the action has been mixed today, but I have not seen anything too bloody to push me off the running list of setups we are tracking.

If anything, bears may need to closely reevaluate any thesis they have for a rollover before the coming July 4th, patriotic holiday, if we do not see stocks reverse course by the end of this week.

Specifically, after this June Fed Meeting is when we typically see K-12 schools in the northeast let out for summer vacation. Thus, traders often take extended vacations after the June FOMC through at least July 4th weekend. I therefore expect volumes to likely taper off by next week if we fail to see any type of downside fireworks.

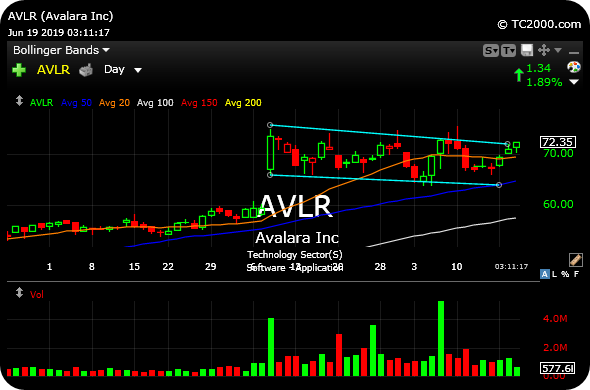

As for specific names, allow me to talk my book. I went long AVLR yesterday inside Market Chess Subscription Services with a stop-loss below $66. I am amazed at how under-watched this software growth stock is, despite its excellent performance and buy volume pattern since the late-winter months.

Either way, keep in mind that markets often like drifting up into the quintessential patriotic holiday. Time is, indeed, of the essence for bears to force the issue. And the FOMC response, thus far, is not helping their cause.