01Jul11:31 amEST

Feels Like July

If you glance at seasonal statistics, July typically serves as something of a reprieve for bulls in the midst of the summer doldrums and periods of volatility if not outright correction. As we know, however, each year in the market has its own quirks. And we just completed a June for the books, especially with respect to the Dow.

Thus, even with this morning's impressive opening gap higher on the indices in light of the apparent "ceasefire" from the U.S./China trade war, we must stay vigilant with respect to assessing the staying power of this move.

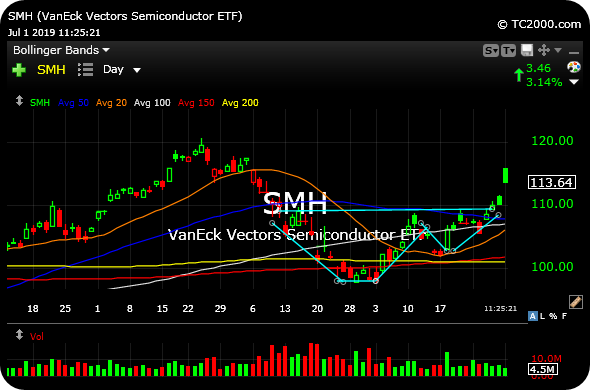

But with the small caps in IWM rallying multiple sessions in a row now above their 200-day moving average, combined with the semis (SMH sector ETF, below, on the daily timeframe) nearly back to all-time highs now after glaring weakness in May, it continues to give bulls hope for a potential summer melt-up scenario (Also note the SMH cup-and-handle bullish formation which appears to be resolving higher, outlined below in light blue).

If chips continue to stage this rotation I have my eye on the likes of AMD CREE, among others.

Finally, I see gold miners are still working off their recent strong rally. As we have noted since last week, chasing the miners is a tricky proposition. But, again, if this gold rally is the real deal then this dip should be bought within a week or two. I am keying off the $24 area on the GDX ETF for clues, as it now coincides with the senior gold miner ETF's 20-day moving average.