23Jul10:54 amEST

Those Should Be Tears of Joy

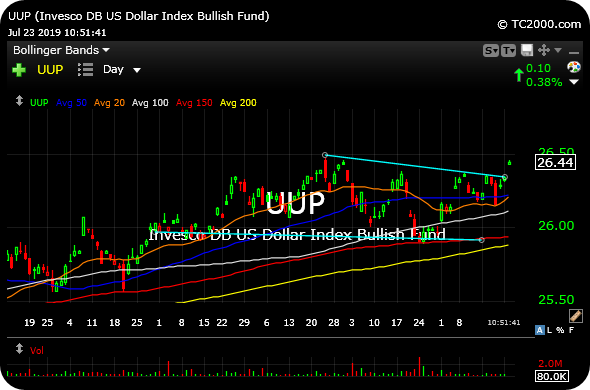

Gold miners are slightly fading this morning after their latest push higher. At first blush, seeing the U.S. Dollar ETF (versus a basket of developed economies' currencies), UUP, on the updated daily chart, below, breaking higher out of consolidation would seem to be prima facie bearish for the entire precious metals and mining complex.

However, it is worth noting that metals and miners have handled themselves quite well this summer in spite of the greenback staying firm, or at least not sliding back down. Typically, the Dollar and precious metals have an inverse correlation, though not always in lockstep.

Still, to see the precious complex have the rally it did this summer without the Dollar free falling is quite impressive indeed.

Going forward, as long as this likely next consolidation in the precious miners stays fairly shallow, albeit with some expected shakeouts in a high beta commodity-related sector, the Dollar bounce should be giving gold bugs tears of joy for the chance of a lower risk entry into a dip rather than tears of sadness.

After all, if the gold rally is something more than just the early-summer fling we have seen heretofore, then by definition names like AG GFI KL NEM SAND SSRM WPM will necessarily be presenting us with better entries in the coming weeks.