10Sep3:45 pmEST

A Tale of Two Pullbacks

Another session of glaring weakness in the Nasdaq, combined with abrupt, heavy bouts of selling in winning consumer discretionary stocks (e.g. CMG SHAK WING) likely outweighs any progress made by both small caps and lagging sectors beginning to show signs of life.

Moreover, the morning bounce attempts in suddenly-oversold software growth stocks like MDB OKTA TTD were all met with immediate selling into strength, as most of those names are back in the red into the bell.

During this sloppy, sorting out process of potential rotation into the FOMC next week, we want to pay attention to the nature of the pullbacks in quite a few names out there.

In other words, it is not a "what" question, but a "how" question, as in, "How are they pulling back?"

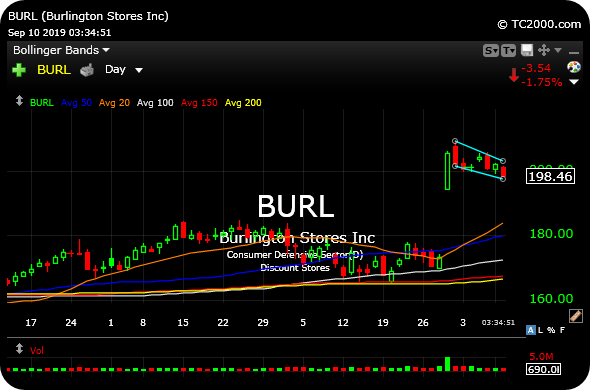

If, in the case of retail winner Burlington Stores (first daily chart, below, of BURL) the pullback is orderly and on low sell volume, we keep a closer eye on it for a potential long entry sooner than later.

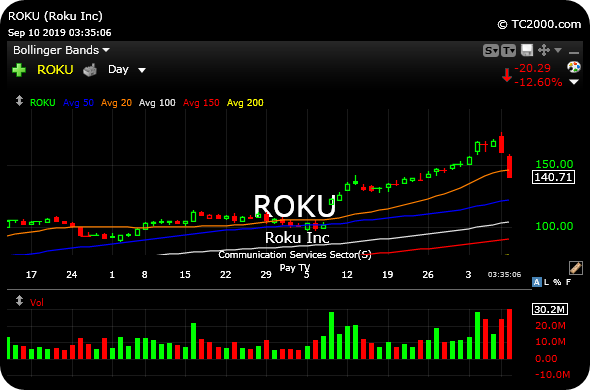

If, on the other hand, we have a growth winner like Roku (second daily chart, below), snapping off on heavy sell volume (bottom pane of second chart) the last two sessions, it is not a long-term topping sign at all, per se. However, it does compel us to exercise patience and to be prepared for a further shakeout.

As they say, momentum cuts both ways.