03Oct10:58 amEST

ISM Sending Out an SOS

Alternate Title: "We're All Economists Now"

Surprisingly weak non-manufacturing ISM data this morning sent stocks sharply lower after what was a modest opening bounce. Clearly, the recent chorus of recession calls seems to be taking its toll on a market increasingly sensitive to economic data. While it remains to be seen if future data, especially tomorrow morning's jobs number, will serve as friend or foe to bulls, the reality is that we are still in a uniquely choppy market regime prone to sudden drops seemingly out of nowhere.

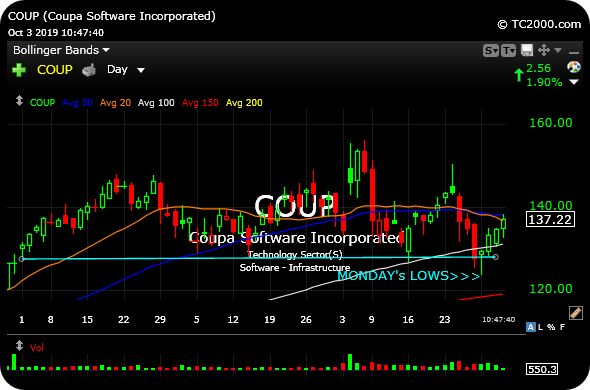

And, yet, with the S&P 500 Index closing in on its 200-day moving average and the small caps at a multi-quarter area of the utmost significance (which we profiled in detail yesterday) there are still glimmers of hope for bulls. Coupa Software (below on its daily chart), for example, the software growth leader, is comfortably above its lows from Monday even in the face of some nasty broad market selloffs in recent sessions.

Surely that may be cherry-picking a name or two, but the larger point is that pot stocks and bios did not confirm new lows into this morning's swoon, either. So even though IWM is struggling again, there continue to be signs of sellers' exhaustion even though we want to wait for a better spot to attack names like COUP, i.e. if and when the indices firm up and are not as prone to sudden selloffs.

As for the actionable here and now, precious miners are catching a nice safety bid. AG is my horse in the race at the moment. But there are a few other miners we are eyeing with Members if gold, silver, and the whole gang resume higher.