07Oct10:54 amEST

In Need of an Oil Change This Fall

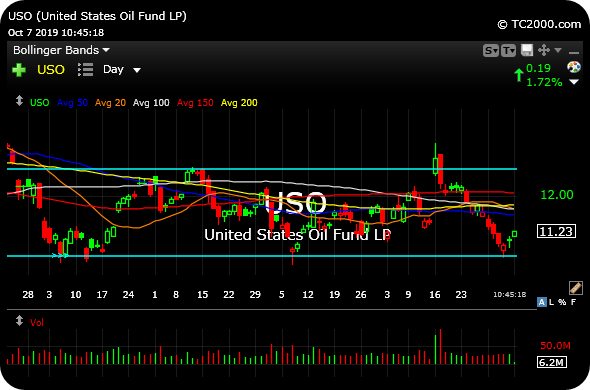

Although not perfectly correlated, it sure seems as though U.S. equities largely begin to act in trepidation with each swoon in crude oil. Gauging the USO, ETF for "black gold," below on the daily timeframe, we can see a reasonable correlation in recent months with equites in terms of each period where volatility increased in stocks with abrupt reversals and gaps lower. When USO held the bottom of the well-defined range (lower light blue line), it served to usher in a respite from the selling and volatility with decent albeit choppy bounces.

Coinciding with the small cap stocks in the Russell 2000 Index holding their well-defined prior support last Thursday, crude oil also bounced and followed-through a bit higher on Friday alongside the broad market rally in equities. Now, this all may seem obvious on the surface.

But with energy stocks (gauging the OIH, XLE, XOP ETFs) lagging for quarters on end, we simply must keep an eye on the sector for signs of stabilization--Not leadership, mind you. Just stabilization and for the bleeding to stop.

The reason why this oil/equities relationship is worth noting in the here and now is that USO is currently higher by roughly 1.75% as I write this while equities are slightly red, well off the overnight lows in the futures. If equities can pull off the full reversal and continue higher with crude today I would consider it another notch in the bulls' belt insofar as making progress.

To be sure, this market still has its warts in terms of bulls needing more quality charts to actually sustain upside breakouts. However, seeing names like NVDA come back to life in a major way after being pummeled and lagging peers for nearly a full year now is exactly the sort of step in the right direction you would expect to see.

So along with the small caps holding last Thursday's lows, let's add crude into the mix as well in terms of absolutely necessary (but not sufficient) conditions to resurrect the market for an end-of-year rally to new highs.

Hot Sector Update 10/04/19 {... Stock Market Recap 10/07/19 ...