02Jan2:12 pmEST

Software Keeping Bears Soft

The strength seen in many of the software names housed the IGV and HACK ETFs (with the latter focused on cybersecurity issues), seems worthy of the a Steve Ballmer dancing GIF given the weakness in small caps and many biotechs today. Heck, even the mid-caps are weak in the MDY, sporting a similarly red, prominent candlestick on daily timeframes that IWM is.

But rotation is the key for bulls, as it was in 2019. And if software can reassert itself it may very well keep broad market pullbacks to a minimum.

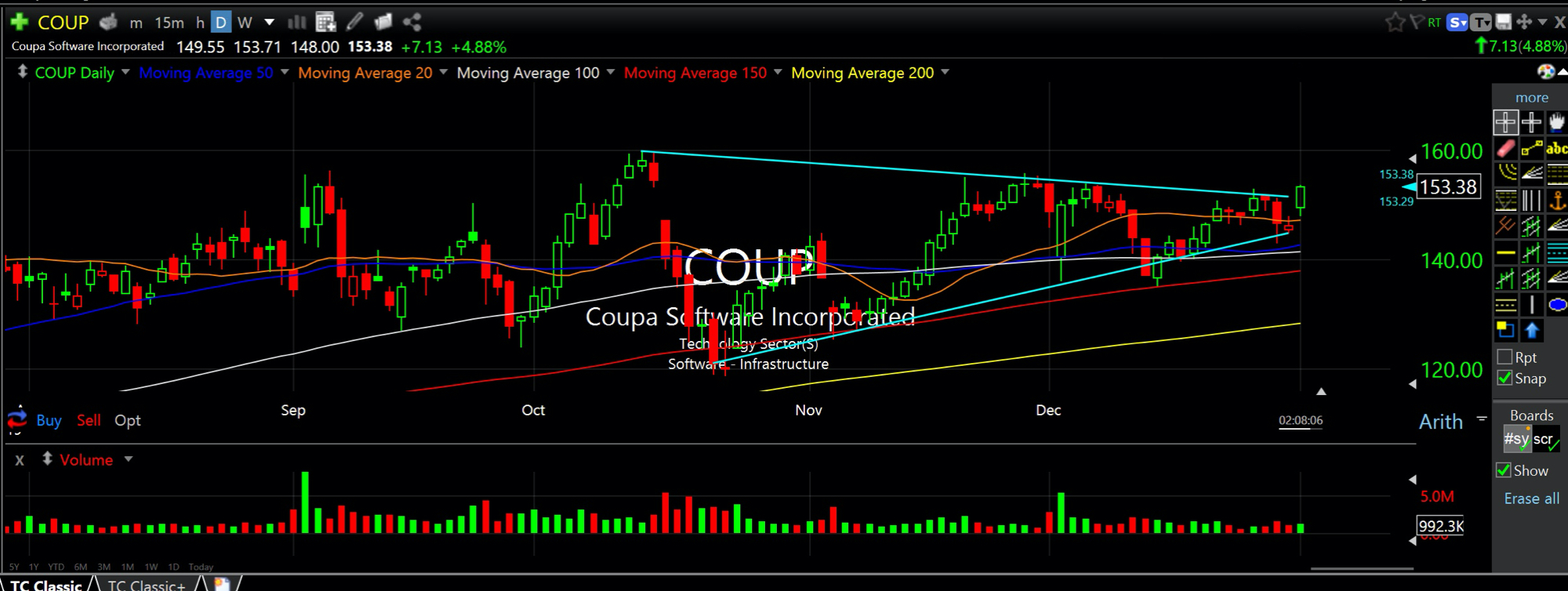

My horse in the race has been COUP for a week or two now, seen below on its daily chart. I am noticing many software names have similar looks, with last week perhaps serving as a shakeout before they move higher.

Headed into Friday and then the first full trading week of 2020, the software and security group seems to be a focal point if nothing else than serving as a key to the near-term broad market movement--A full-blown correction need not be inevitable if this group sustains today's strength.