29Jan9:45 amEST

Wednesdays Are for the Synergies

News of casino operator Penn National Gaming (PENN) buying a minority stake in Barstool Sports is making waves this morning. PENN took a 36% stake for $163 million in cash and stock much higher as I write this, up and out of a massive base consolidation.

To be sure, Barstool has its detractors when it comes to the frat house-style of content it produces at times, toeing or even crossing various lines. But there is no denying the popularity of its brand and the business acumen of its founder, Dave Portnoy--Portnoy is effectively the face of Barstool and is instrumental in the brand's value.

The rationale behind this move by PENN revolves around sports betting, of course, as it becomes increasingly implemented, state-by-state, across the country.

PENN has the "infrastructure," as Portnoy termed it, insofar as regional casinos and racetracks across the country are concerned. Barstool's rabid following should significantly enhance PENN's value over time, and is certainly enhancing its popularity immediately. PENN's next earnings are scheduled for February 6th. But it is hard to see this move as anything but bullish for the future, regardless of how these earnings pan out. True, Portnoy and Barstool can be highly controversial and they may step in hot water at some point, dragging PENN into it as well.

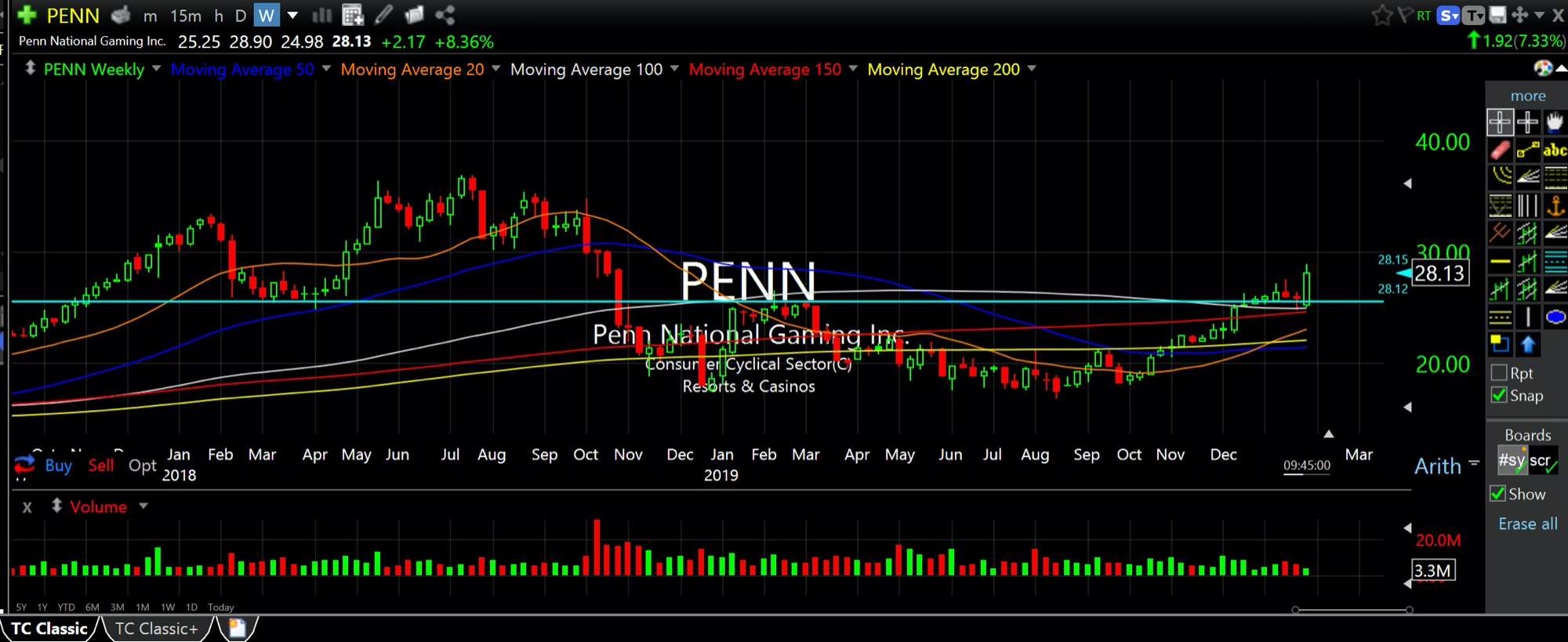

However, this move puts PENN's stock in prime position to push higher for a meaningful weekly chart breakout (below) since it held the key $25.50 support area (light blue line) in recent weeks.

As sports betting becomes more accessible and popular across the land, I expect more and more synergies like these as the notion of fusing popular sports betting content with actual casino/book/track operators likely increases value for all involved.

Stock Market Recap 01/28/20 ... Stock Market Recap 01/29/20 ...