03Mar10:23 amEST

Let's Get Ready to Rogers!

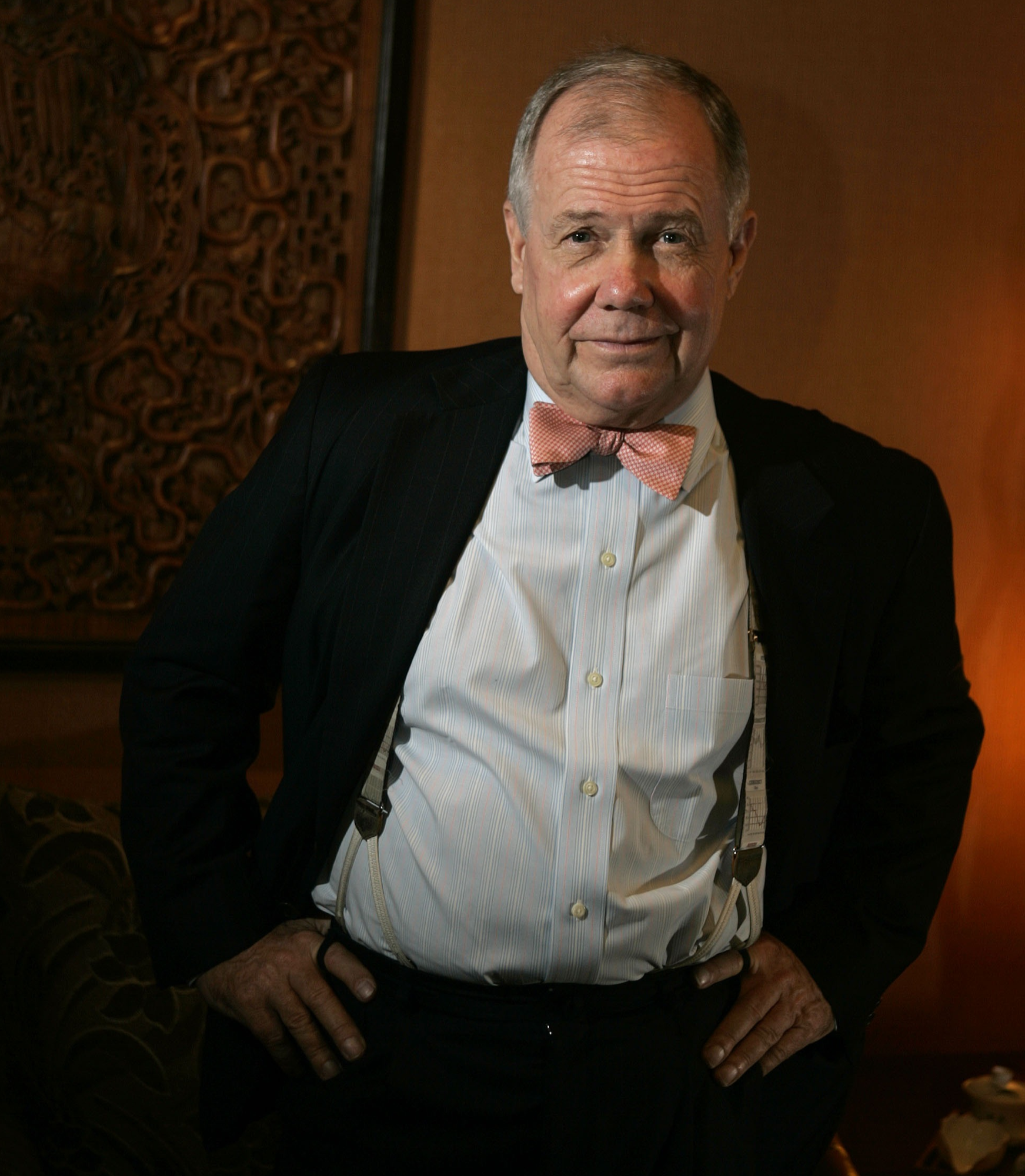

It has been a long time coming, but I suspect the Fed cutting 50 basis points this morning as an emergency measure and means to combat the Coronavirus through their "arsenal of monetary weapons," or however the financial media glowingly refers to the Central Bankers in all of their glory, will finally ignore the much-ballyhooed (at least ballyhooed by the likes of Jim Rogers, Marc Faber, Peter Schiff, even Bill Fleckenstein) commodity-based rally.

Given this Fed action, it is entirely reasonable to think that there will likely be "unintended consequences."

However, and this is a particularly important point, shorting equities as a means to express that thesis could easily be the wrong move for the foreseeable future, and thus remains uniquely risky, what with all of the globally-coordinated easing by Central Bankers. I will say that if stocks buckle under their own weight at this point in time despite the rate cuts, it would be particualrly bearish in my view.

But the most probable scenario is that downtrodden commodities like natural gas, oil and energy stocks, agricultural soft commodities and ag stocks, and of course precious metals and derivative miners on top of the base metals and miners all begin to find bids just when they looked most vulnerable to sinking into the abyss.

As an example, consider the JO weekly chart, below, which is the ETN for the coffee commodity. Coffee is gapping up nicely, rate cut or not. But note the structure of the weekly chart, with the base bottom potential and strength here threatening a fresh move up. That said, I expect the rate cut to add fuel to the fire.

Stock Market Recap 03/02/20 ... Stock Market Recap 03/03/20 ...