05Mar11:38 amEST

Cruise Line Stocks: Don't Pull a Guggenheim

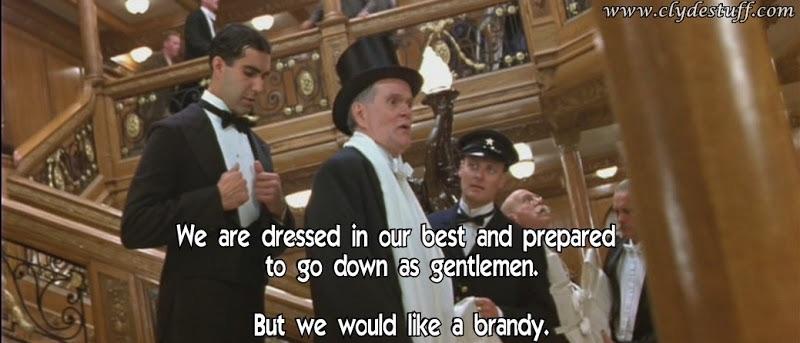

As portrayed in film and television, Benjamin "Ben" Guggenheim was one of the more famous people to sink with the Titanic more than one-hundred years ago in the Atlantic Ocean. Guggenheim was supposedly rather gallant in his desire to go down with the ship as a proper gentleman. And thus we can admire the dramatic form but learn the lesson of doing what needs to be done to survive in lieu of bravado.

In the case of trying to salvage sinking cruise line stocks (CCL NCLH RCL are the three main ones which are publicly-traded), we ought not yet adopt Mr. Guggenheim's doomed gallantry.

Case on point: Carnival, often seen as the lower end cruse line of the majors and often at the center of on-board illnesses and controversies, could easily move down towards its prior bear market lows from 2000-2002 and 2008-2009, as seen on the CCL monthly chart, below.

While I recognize that seems extreme, especially considering the broad market is not yet in a bear market, we do want to acknowledge that the CoronaVirus headlines have amounted to a massive negative feedback loop to the point where The Fed took the rare moment to make an emergency rate cut. Airlines seem bad enough as is to travelers who fear the virus, but cruise lines? The thought of being stranded at sea and not allowed to leave indefinitely is too much to bear, even if it is somewhat far-fetched.

Hence, although I suspect the cruise line will represent excellent value at some point, I hesitate to say that time is now.

As for RCL and NCLH, NCLH is the more intriguing name for me to go after first. It is actually not far from its 2013 IPO price, and I suspect down below $25 would attract some buyers. But, again, that is still about 20% lower from current prices.

Biotech Sector Rundown 03/04... Stock Market Recap 03/05/20 ...