A clearly bifurcated market is taking hold this morning in far more of a pronounced way than we have seen of late.

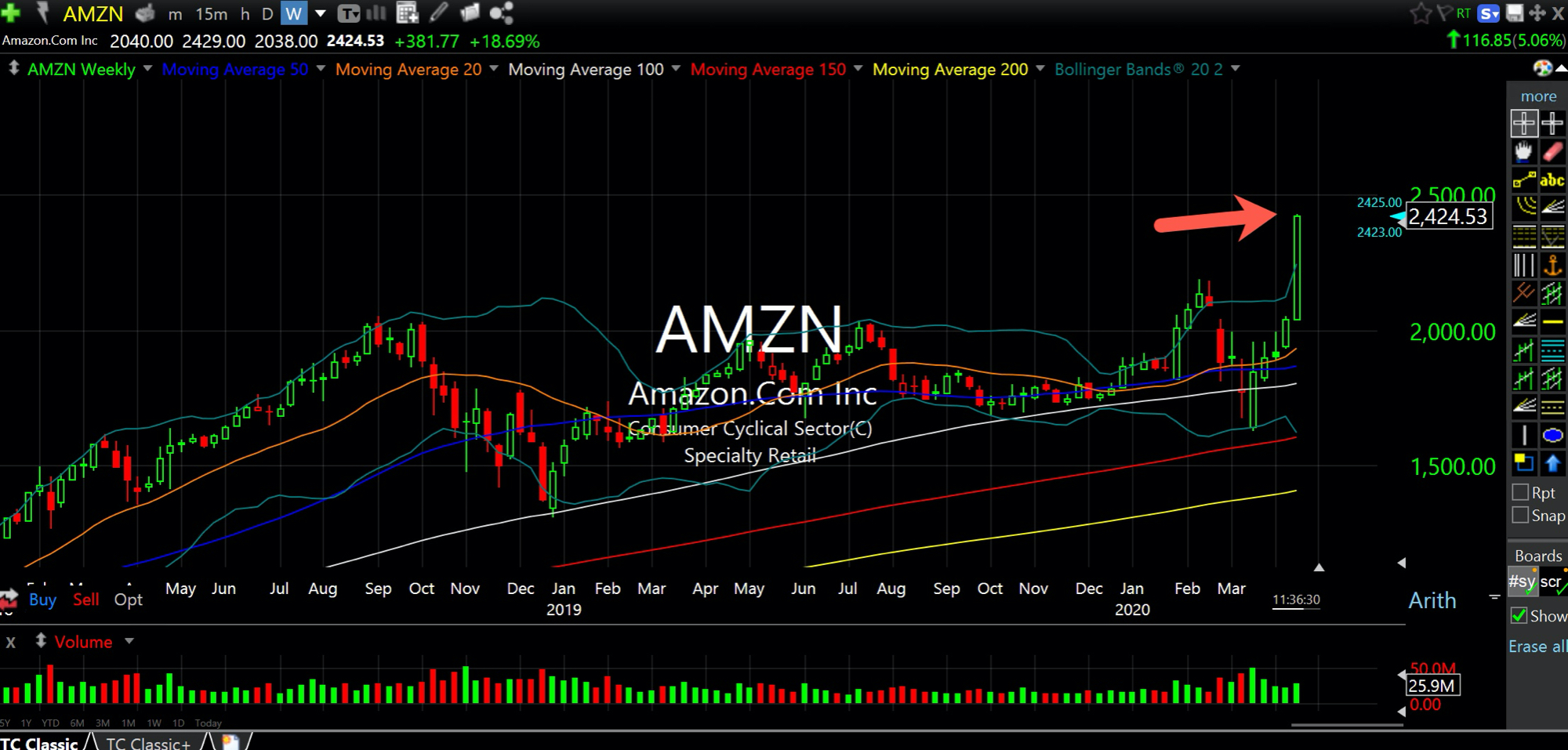

The persistent strength in the QQQ, ETF for the top-100 stocks in the Nasdaq Composite, be it AMZN NFLX NVDA TSLA, among others, is garnering headlines and serving as obvious talking points for bulls to argue the case for the March lows clearly holding and a new bull run underway.

On the other side of the tape, however, are several parts of the market which are not nearly as glamorous in any type of market as the QQQ names, let alone in this tape with their lackluster performance.

Small caps, financials, REITs, insurers, transports, as well as another downdraft in crude oil are all sore spots today, once again.

Indeed, the AMZN weekly versus the USO weekly charts, respectively below, illustrates such a wide spread now between the two that it is beyond a situation of mere winners versus losers.

No, what we have here is a situation of notable extremes. Capital constantly pouring into AMZN and QQQ friends as they are obvious winners, while capital staying away from oil, small caps, financials, REITs, insurers, and transports as they are obvious losers. And thus the bifurcation.

The only problem with that is just how obvious everything is now--We seem to know the clear winners and losers of the extended lockdown, virus, and looming attempts at re-opening various states across the country...

...or do we?

Considering how historical and unprecedented the pandemic, response, and economic fallout are, it sure is interesting to see how cocksure many people seem to be about how the market has already "priced in" the worst (the same was said in early-2008 after Bear Stearns was pawned off to JP Morgan for $2 per share, by the way. As we know, March 2008 was nowhere close to "pricing in the worst").

But in terms of the composition of the market and its various sectors, bifurcation to this degree is typically unsustainable and, ultimately, unhealthy. I would change my tune if the lagging sectors can catch a sustained bid anytime soon while the QQQ names enjoy mild respites. But I'm not holding my breath for that scenario to materialize.