06Oct11:30 amEST

It's Harvesting This Autumn

We have some glaring rotation attempts taking place today, with the small caps in the IWM ETF for the Russell 2000 Index clearly leading higher for bulls. However, many other parts of the market are acting lethargically, at best, if not outright churning before a drop. These competing forces may very well persist as the market awaits word on the latest stimulus stumble out of Congress, not to mention everything leading up to the election in a few weeks.

Software got off to a red-hot start but the IGV sector ETF suddenly back to the flatline as I write this, and chips are not far off from that fate, either. AMZN and ZM are red and lagging just as they were yesterday. This is all happening while the agribusiness stocks are acting quite well, going virtually unnoticed, to boot.

As we profiled both here and with Members yesterday, the unpopular ag stocks seem ripe for rotation. The actual soft commodities like corn and wheat are having strong weeks, so far, as are ag names like BG and MOS.

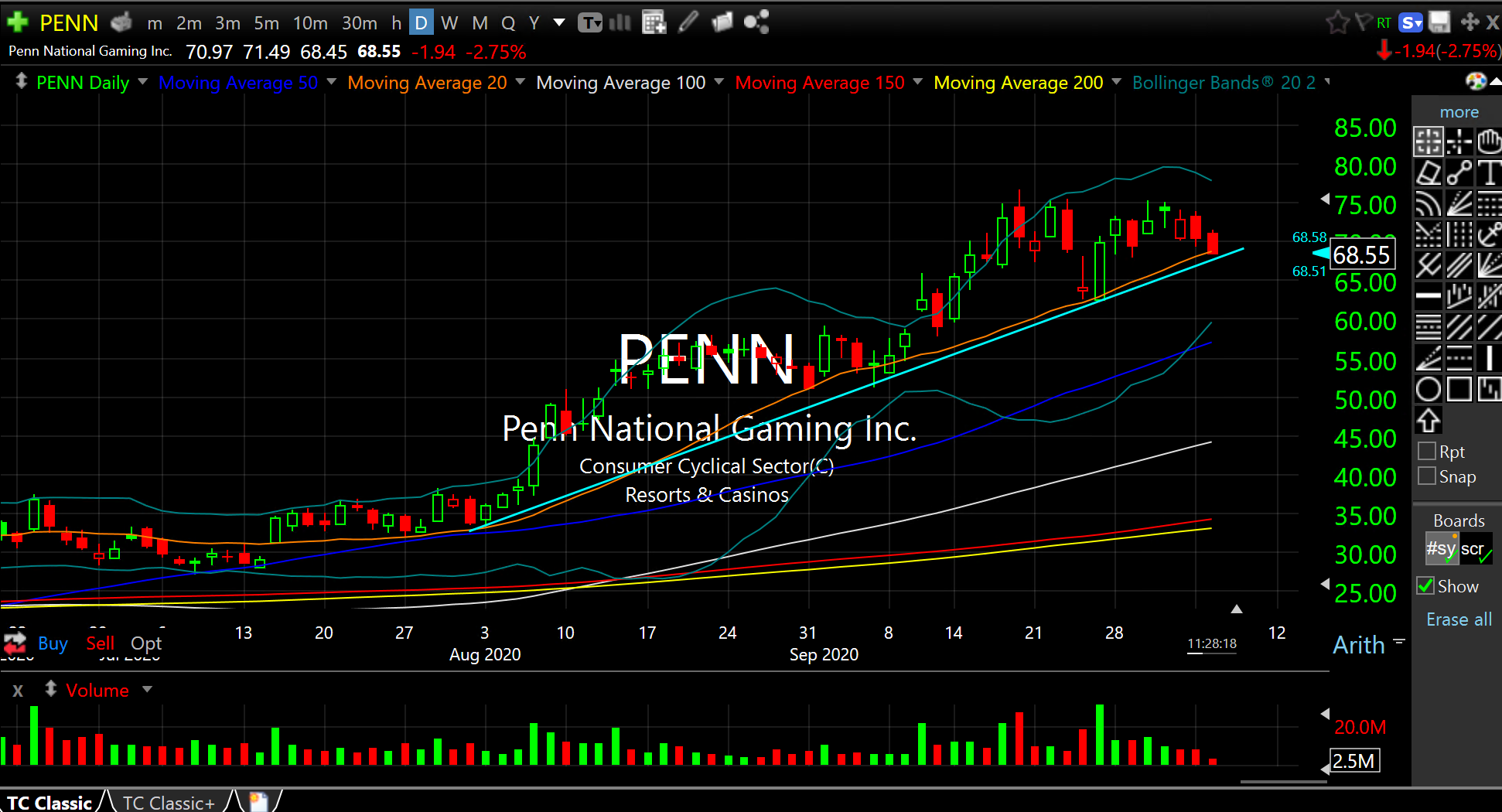

Hence, we seem to be perfectly set-up for a cool kids down to unpopular kids rotation, which means very trendy and logically rather bullish names like PENN will likely come in and test some levels below in the coming days and weeks, stimulus or not. On the PENN daily chart, updated below, a steep and well-defined support trend-line has yet to bring in strong buyers this week. The stock, and DKNG, have taken the online sports betting trend to the max early on in this phase.

But sooner or later the discounted growth becomes a factor, and profit-taking is inevitable as some of the newer hot money traders will find out.