07Oct3:56 pmEST

Is That Jinko or Jenga?

It takes some serious onions to consider shorting individual solar stocks here in size, what with their relentless upside momentum likely in anticipation of a "Blue Wave" come Election night which eventually leads to a version of a Green New Deal.

We can debate politics from now until kingdom come, but that is what the solar space seems to be projecting, at least for now. Whether that materializes remains to be seen on or just after November 3rd.

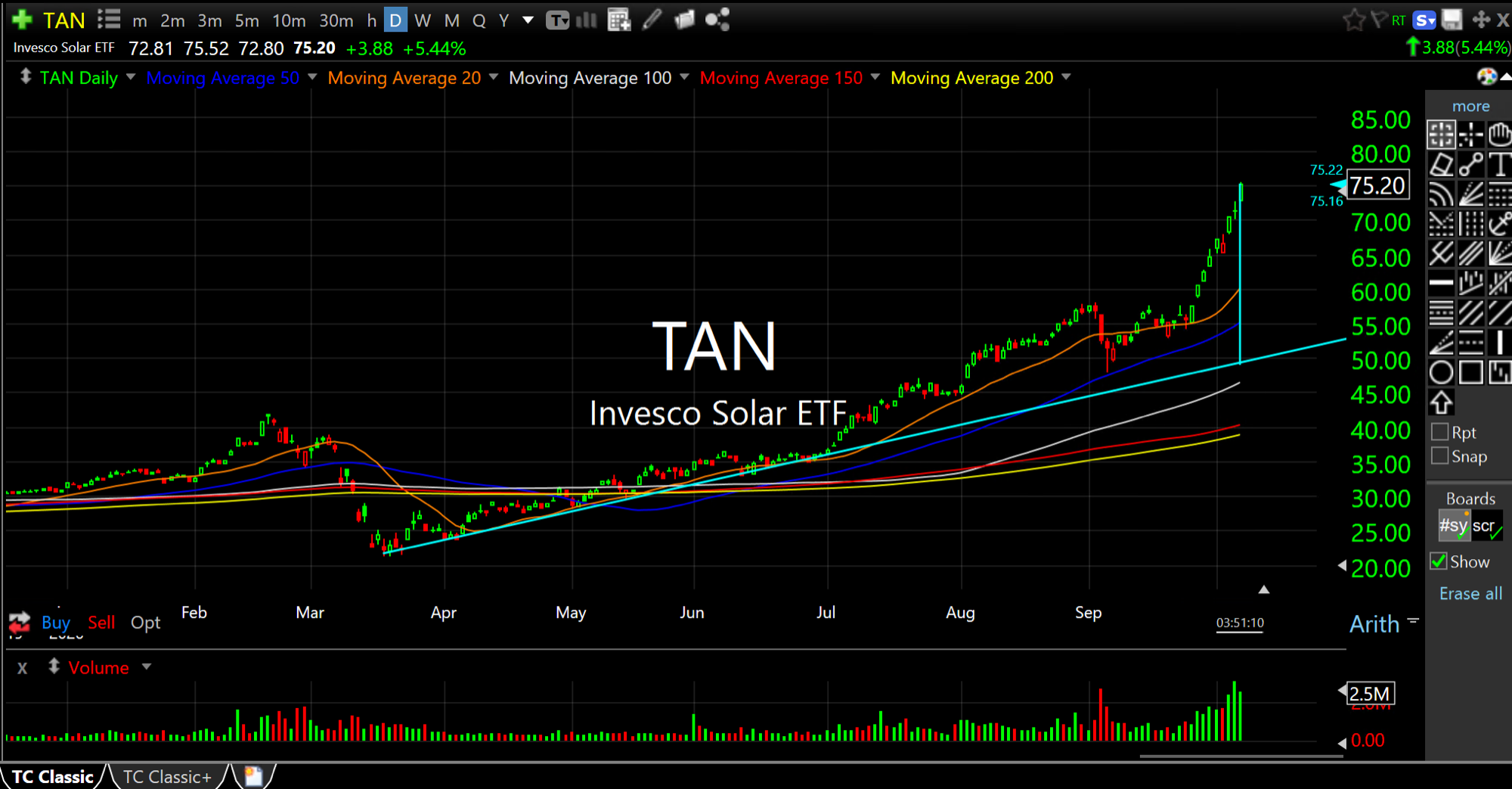

In the meantime, we assume the market has it generally right. And shorting individual plays like, say, JKS (a China name, ironically), or domestic stalwarts of late like ENPH RUN SPWR VSLR, all seem logical albeit riskier than buying puts or shorting the sector ETF, TAN, seen below on its daily timeframe.

With TAN, at least you have your risk spread out across the sector, in lieu of the one-way freight train the likes of JKS have been on since Labor Day, with Jinko appreciating from the teens to a high today of $56.40 (!). Indeed, shorting individual solars in the midst of this squeeze and bull run in hopes of many political tailwinds feels like playing a high stakes game of Jenga, rather than playing Jinko, per se.

But, again, TAN seems to be a bit more logical.

Also note the unusual and typically unsustainable extension of spot price from the basic trendline support dating back to the March lows, both of which I have highlighted, below. As bullish as the sector feels and may very well be, a near-term reversion fade still figures to be a high probability bet, especially with the potential for a respite before another pre-election night move.