07Dec10:32 amEST

The Death Knell for Tesla Shorts

Although it seems like just the opposite, given this morning's further strength in shares of Tesla as it awaits inclusion to the S&P 500 Index two weeks from today, we are seeing signs that the (likely) much-needed short squeeze in the name may be close to finally running its course.

And I have two pieces of evidence to support that last sentence.

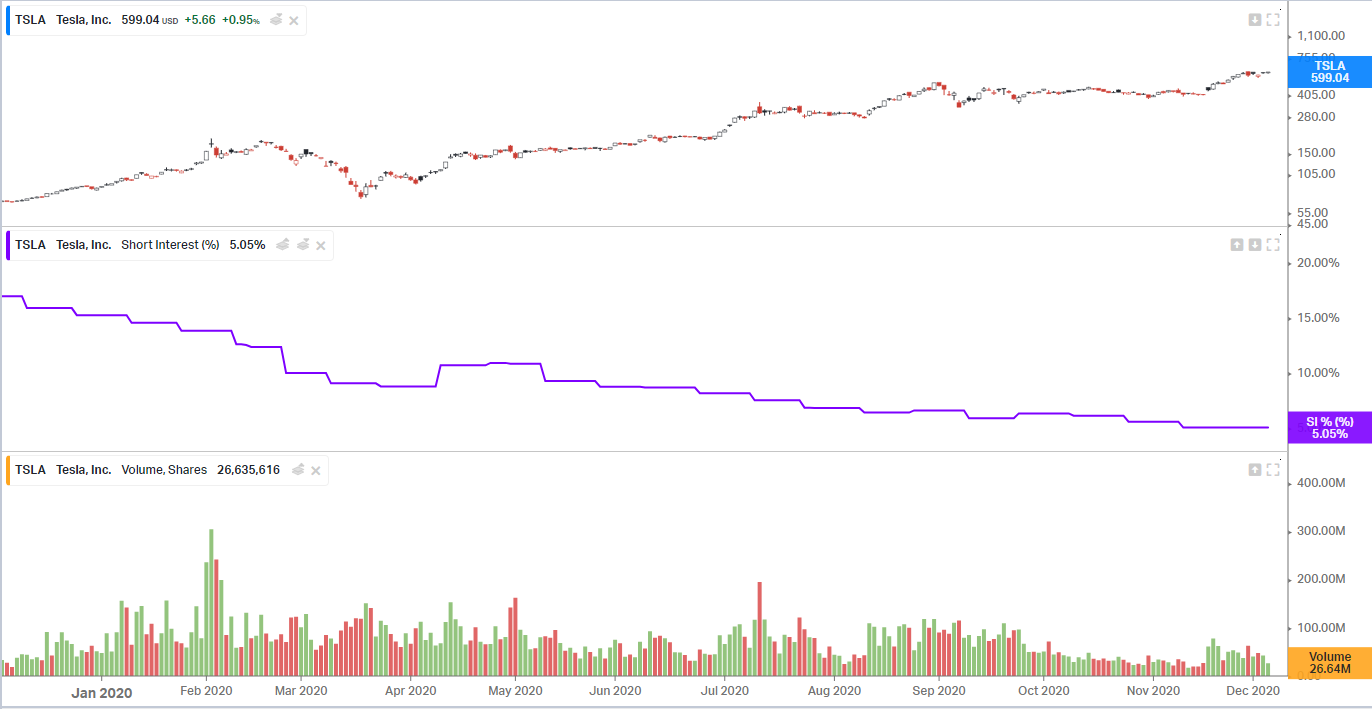

First, note the steadily declining short interest, seen in the middle pane of the chart, below.

Seeing short interest decline to this extent was, again, likely much-needed to eradicate the chorus of "TSLAQ" chants we heard from bears almost on a daily basis for years, claiming the company was a sham. Mind you, they had some valid points on some issues. But from a market mechanics perspective, the risk of the crowded and hated squeeze was just too high.

And once it got going...boy, did it get going.

Again, we are seeing signs that the squeeze is in the preverbal ninth inning, however.

The second piece of evidence is high profile short-sellers like Jim Chanos is backing off his TSLA short position size, a way of hm saving face somewhat but also, essentially, admitting defeat. Chanos is no slouch, having shorted Enron into the ground. But this time around he got caught and now he is capitulating in his own way.

Hence, we may finally be near a genuinely contrarian bearish spot for TSLA without getting squeezed with the other shorts who are steadfast in their belief of the company being a bloated pig--They still feel that way, but they are either out of the name by now or out of markets altogether.

Recall that being a contrarian means not having a gang of buddies cheering you on or in your foxhole with you. The idea is to be the lone wolf on the frontier, risking it all, either way.

In the case of TSLA, I still would not short common shares for a variety of reason as a way to express a bearish bet. However, I would be looking at puts expiring in February/March into this morning's 4-5% pop, given the thesis that it is much more contrarian to be bearish TSLA now that it has been in at least seven years.

Weekend Overview and Analysi... Stock Market Recap 12/07/20 ...