19Jan10:48 amEST

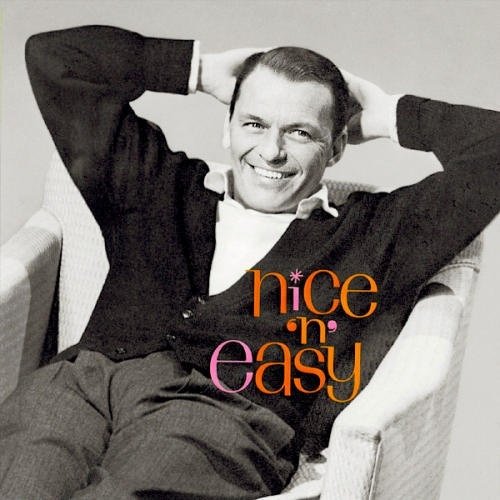

Update on Twitter: Nice 'N' Easy Does It

Uniquely forgiving markets like these tend to condition traders to focus even more on instant gratification and instant success. As long as the party goes on, shorts in names like BB GME LAC remains vulnerable, especially the crowded shorts like GME GOGO SDC, etc..

But over time there is always a premium placed on patience, a discipline unto itself.

And when it comes to gauging dips in names like FB or TWTR after the recent censorship issue, more patience may be required than usual.

On the updated TWTR daily chart, below, the 50-day moving average (arrow) failed to offer support on the initial dump after the news event. That was our cue to not add more (in my long-term account, where I have owned TWTR since the teens several years ago in the VIP arm of Market Chess Subscription Services and tracked the idea on this website as well) nor to buy even for a swing trade.

As it stands now, I suspect a 200-day moving average test, below, to the $40 area now seems likely.

Note that Facebook has already tested its 200-day and is bouncing modestly this morning. However, it would not surprise me to see FB spend a few weeks down at these levels possibly forming a new base.

There has not been a laid back vibe to markets in a while, as we saw a bonafide multi-week crash last year quickly morph into a nonstop, manic melt-up. Sooner or later, I expect a reversion to calmer waters in some respects, where nice 'N' easy will do the trick in terms of waiting on proper entries.

Holiday Overview and Analysi... Getting a Little Chippy Out ...