31Mar10:56 amEST

Shallow Hal Market

The growth darlings during the heart of 2020 (from the March lows through about Halloween/Thanksgiving) went from looking like, shall we say, one version of Gwyneth Paltrow in

Shallow Hal (2001) to, shall we say, another version of her. As it stands now, many of the hot-to-trot growth names of 2020 are not looking very good at all on daily timeframes, and sentiment sure reflects that.

With this morning's Nasdaq-led rally in the market, for example, sentiment seems to be more in wait-and-see mode. This sentiment likely reflects how many aggressive growth traders have been burned in recent months by their beloved growth socks who finally let them down after rewarding their buy-and-dip prowess handsomely throughout 2020.

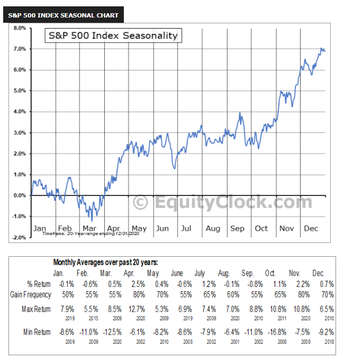

Recall that we are still in a seasonally rather bullish time of year, seen below on the EquityClock.com chart. The next few weeks give a window for bulls to stage, perhaps, another (and final?) leg higher before we eventually must contend with capital coming out of the markets to 1) Pay taxes, and 2) Put back into the real economy as it re-opens.

Until then, with sentiment washed up in names like BMBL MTCH PTON ZM, and indeed many software and biotech stock at-large I am open to playing them for relief rally with a finite timeframe in mind. Sports betting and general gaming plays like GNOG also fit into this category.

At a minimum, with ARKK and TSLA holding prior support yesterday and reversing higher, eager bears should be willing to show some more restraint perhaps into mid-April before trying to hit the tape with heavy shorts.

As for the materials and infrastructure theme, we have been selling into pops and will opportunistically look to reload names like CLF USCR X and others into dips and shakeouts.