10May11:00 amEST

We Are All Probably Overlooking Platinum

A brutal open for tech, namely ARKK and TSLA, among many, many other high beta growth stocks, is clearly spoiling Monday morning for many traders. Materials and energy have select strength, alongside the continued melt-ups in banks and homebuilders which are helping the Dow and S&P stay either green or only slight down to mask the Nasdaq weakness. However, it is disappointing to see solars continue to slide.

Retail is mixed, though I like what I am seeing with the health grocer SFM bounce back after earnings. And utilities are getting plenty of interest for their dividends and general value proposition.

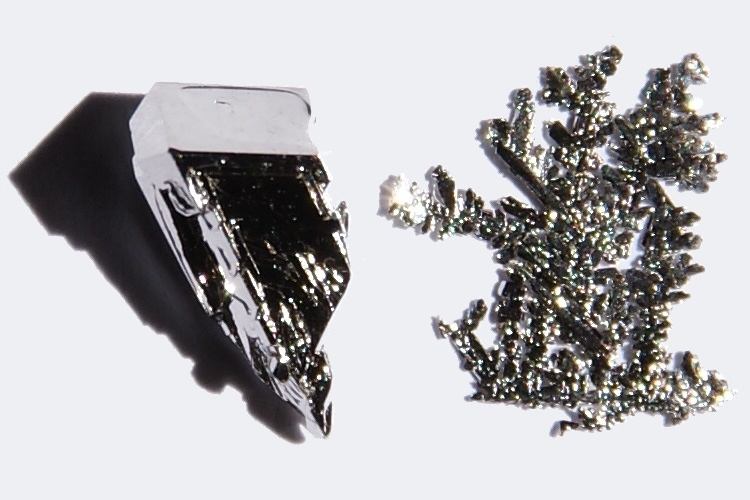

On the topic of value, one metal which is often overlooked but tends to do exceedingly well in terms of inflationary pressures is platinum.

PLTM, below on its weekly chart, is an ETF for the metal. Platinum earned its name from the Spaniards, as it is derived term "platino," meaning "little silver." With a very high melting point and its chemical stability, platinum can be both useful in industrial processes and overall quite valuable.

Note the PLTM base threatening to break higher and take out the February highs.