08Jun10:02 amEST

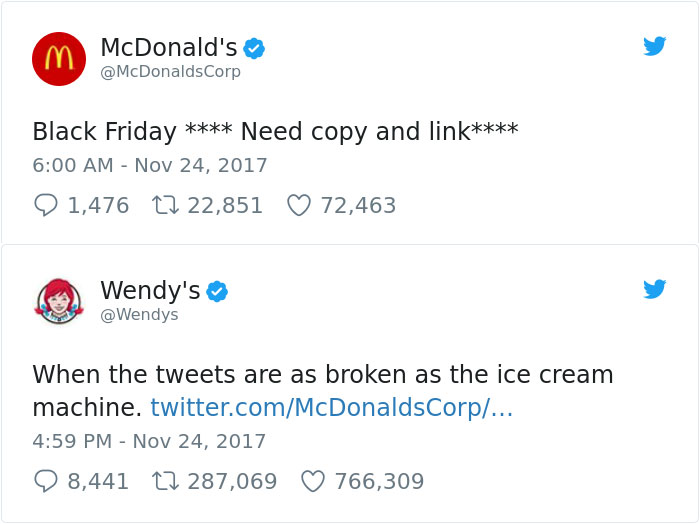

Wendy's: Closing it on Reddit

With a revamped and innovative menu, many updated stores, and probably the most appealing corporate social media account out there, it was not necessarily an easy decision for me to sell Wendy's as a long-term investment this morning. However, as I just noted in an email to VIP Members of the long-term investing arm of the service, the Reddit-related pop this morning was simply too much of a gift, considering this is still a business in the food industry.

After all, if inflation is not, in fact, transitory, and we are merely in the early innings of the cycle, restaurants are still going to face continued wage price pressures in addition to higher food input costs. Yes, Wendy's is in a good position compared to Mom & Pop shops to adjust, but headwinds are still headwinds.

And I am not so sure the cool kids arrogantly blurting out "transitory" multiple times per day have truly thought this cycle through.

At any rate, Wendy's was a long-term investing play I first presented to VIP Members back on September 17th, 2017, trading with a $16 handle. It has been a wild ride ever since, especially the March 2020 plunge. But long-term investing required a different discipline at various times than swing trading. While WEN could be on the cusp of another leg higher, my feeling is that valuation is not cheap, and the firm is in an industry potentially facing multiple headwinds in the coming quarters.

I'll use the Reddit pop to my advantage and gracefully exit.

A Party is a Party is a Part... Stock Market Recap 06/08/21 ...