15Jun11:21 amEST

Playing the Waiting Game

We are finally seeing some legitimate concern and, at least, acknowledgment by markets that the FOMC tomorrow afternoon represents some type of risk in terms of the possibility The Fed may hint or outright focus on tapering/tightening. And with a hot PPI number this morning (not to mention Kyle Bass on CNBC declaring the true inflation rate to be around 12%), language on the Fed statement and/or presser tomorrow about fairly imminent tapping would be entirely justified.

Of course, we know with this iteration of The Fed that entirely reasonable actions are never a given. And there are quite a few seasoned investors out there fully expecting the Fed to stay ultra accommodative. Personally, I would rather trade a defined reaction after the events of tomorrow afternoon, which we hopefully get to set the tone into the heart of summer trading.

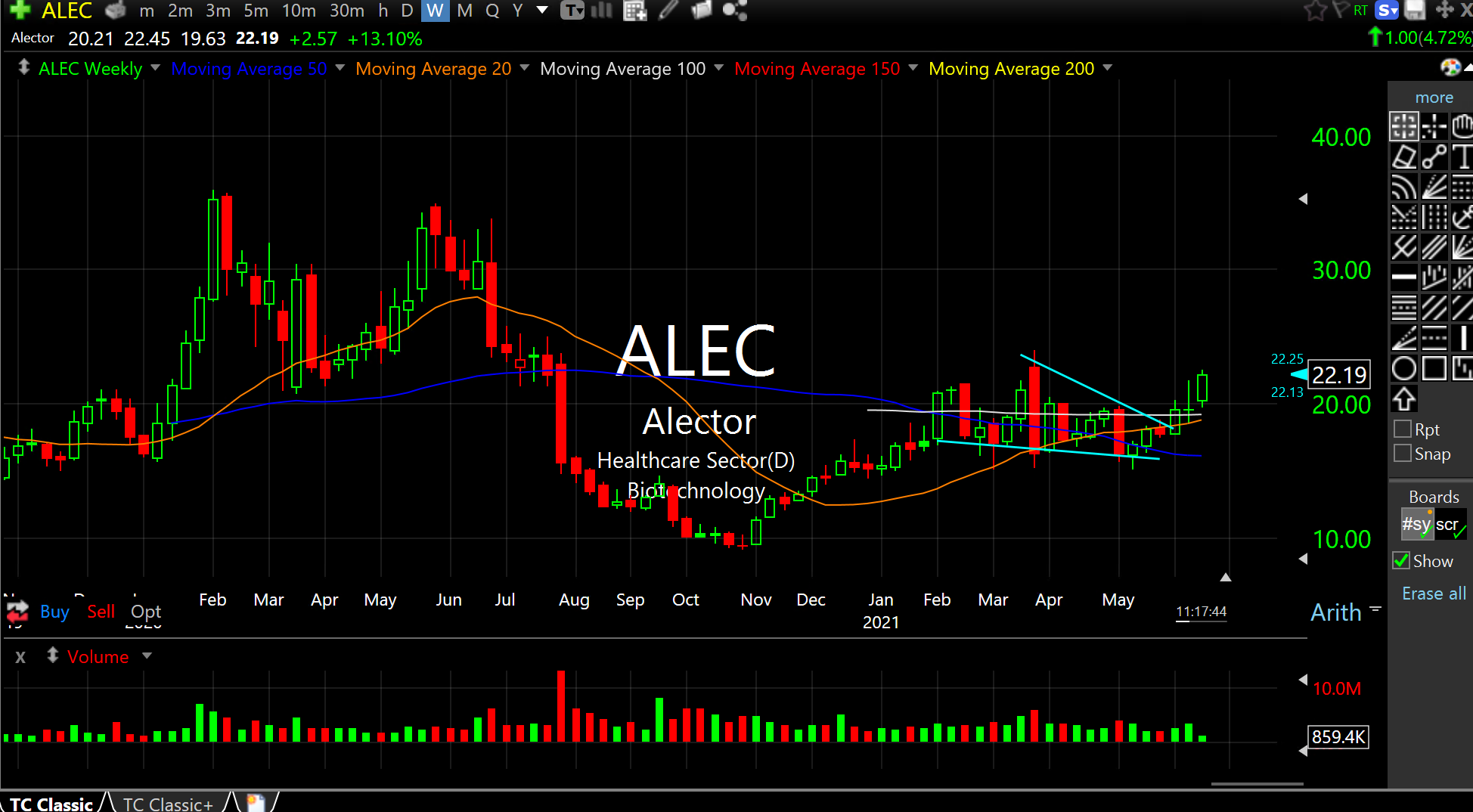

In the meantime, we have a market featuring mostly dipping and squishy action today. Select biotechs like NTLA, which we sold into the morning green, have been strong overall, as well as Alector, below on its weekly chart. ALEC is a $1.7 billion market cap immuno-neurology play. You can see the tightening action of late and relative strength to peers. If we do get a positive post-FOMC reaction, I would be looking at a play like this, and NTLA into a dip, for fresh longs.

Also of note today is the Hindenburg Research note on its DKNG bearish thesis. The market deemed it sufficient to sell off most sports betting plays today on top of DKNG itself, given Hindeburg's recent success with these sorts of theses.

Stock Market Recap 06/14/21 ... Look at Box if The Fed Doesn...