22Jun10:55 amEST

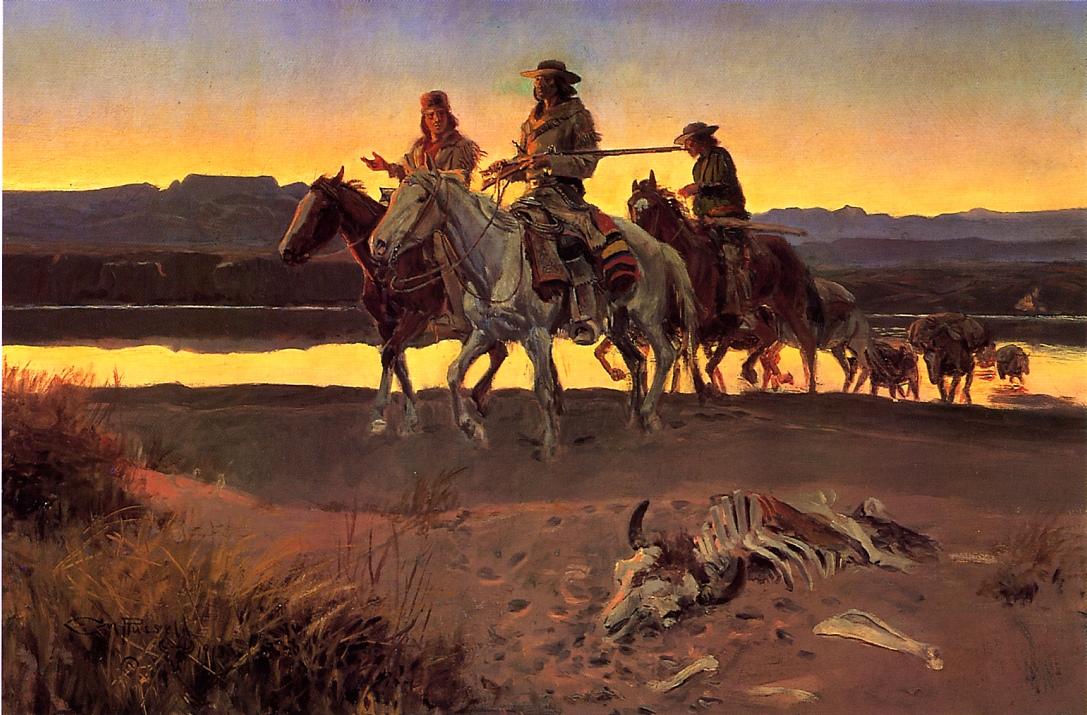

It's Still a New Frontier

The temptation with crypto for many seem to be to favor extraordinary bold prognostications all the way around. Bitcoin, and indeed crypto at-large, is said to inevitably dominate the future of the world as we know it. Others may not believe that entirely, but they sure do seem convinced that gold is a pet rock, the fiat U.S. Dollar will collapse, and Bitcoin/crypto will keep rising in power and popularity. Others say Bitcoin is essentially a massive chain letter, in effect a Ponzi scheme destined to collapse dramatically. Fewer people, however, seem embrace a bit more nuanced idea that Bitcoin and other prominent crypto coins may very well survive, even thrive, longer-term, but that does not rule out intense bear markets/crashes where many of the alt-coins collapse to zero amid horrifying destructions of wealth.

Whichever way you view crypto, the move in Bitcoin below $30,000 overnight and again this morning seems to be garnering an awful lot of hype. We could easily be on the cusp of a near-term relief rally higher, this one perhaps a bit more better for bulls than the attempts in recent weeks/months, even as crypto-related stocks like COIN MSTR and the BLOK ETF struggle.

Another interesting aspect of the weakness crypto overnight into today is that the QQQ is unperturbed by it. For a while now, there has been a theory floating around that Bitcoin weakness could/would/should derail the Nasdaq. But as we are seeing today, perhaps, it is going to take a whole heckuva lot more than Bitcoin flirting with losing $30,000 to do just that.

Overall, as many chartists extrapolate a monstrous Bitcoin topping pattern as meaning crypto simply must head lower, I am mindful that we are still dealing with a new frontier and careful not to be dogmatic with that asset class at this point.

My concern is more rested on tech stocks and seeing whether quality long setups like BOX can trigger and break out amid the crypto noise.

Stock Market Recap 06/21/21 ... Stock Market Recap 06/22/21 ...