13Jul10:53 amEST

Out in the Cold in the Middle of July

Another day of poor breadth and weak small caps on the open seems to be irrelevant, once again, as upside reveals in the face of a hot CPI print in the QQQ and even TLT gives bulls some breathing room this morning. Interestingly, despite the growth stock pop we have ARKK red alongside many of its underlying components.

Still, this type of price action reinforces the idea that being too early for the big short is simply equivalent to being dead wrong and thus requires vigilant risk management in the form of respecting fairly rigid protective stop-losses. The party will not last forever, especially when it seems like it will. However, bears shorting QQQ are the ones being left out in the cold right now in July.

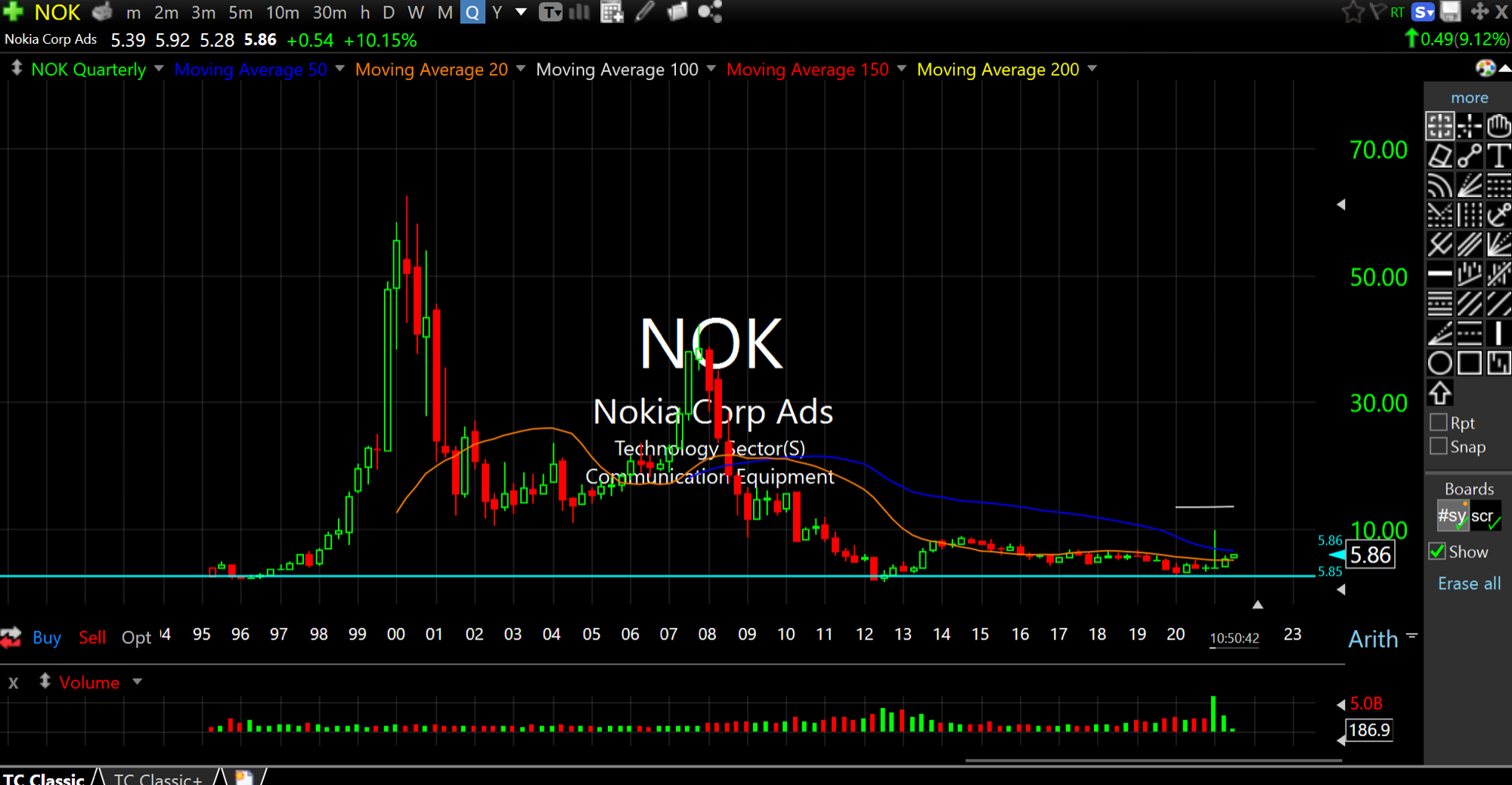

Separately, a several beaten-down name over the last two decades, Nokia, is popping nicely on upped guidance this morning. One of our Members flagged this name, on its daily and then quarterly charts, respectively below, as being a possible long-term turnaround play. And while I do not own NOK long-term, if the stock holds $5.70 into dips now I would consider it as a swing trade and take it from there.

Alongside a few other names, Nokia is a good reminder that not all tech is growth and not all growth is tech.

Stock Market Recap 07/12/21 ... Stock Market Recap 07/13/21 ...