10Sep11:20 amEST

Next Train to Somewhere

The sheer amount of indecision in the market action of late is likely a reflection of internal competing forces.

On the one hand, the market is aware of supply chain disruptions in the economy, but has not had a full-blown reckoning of it and has come nowhere close to acknowledging how lasting it may be. The market is aware of the intense interventionist measures by The Fed, but has not had a reckoning of it. The market is aware of how expensive some growth stocks truly are, such as OKTA ZS, even MSFT GOOG, but has come nowhere close to a full-blown reckoning.

And so it goes, as we see-saw on a daily basis with fades, reversals, head-fakes galore.

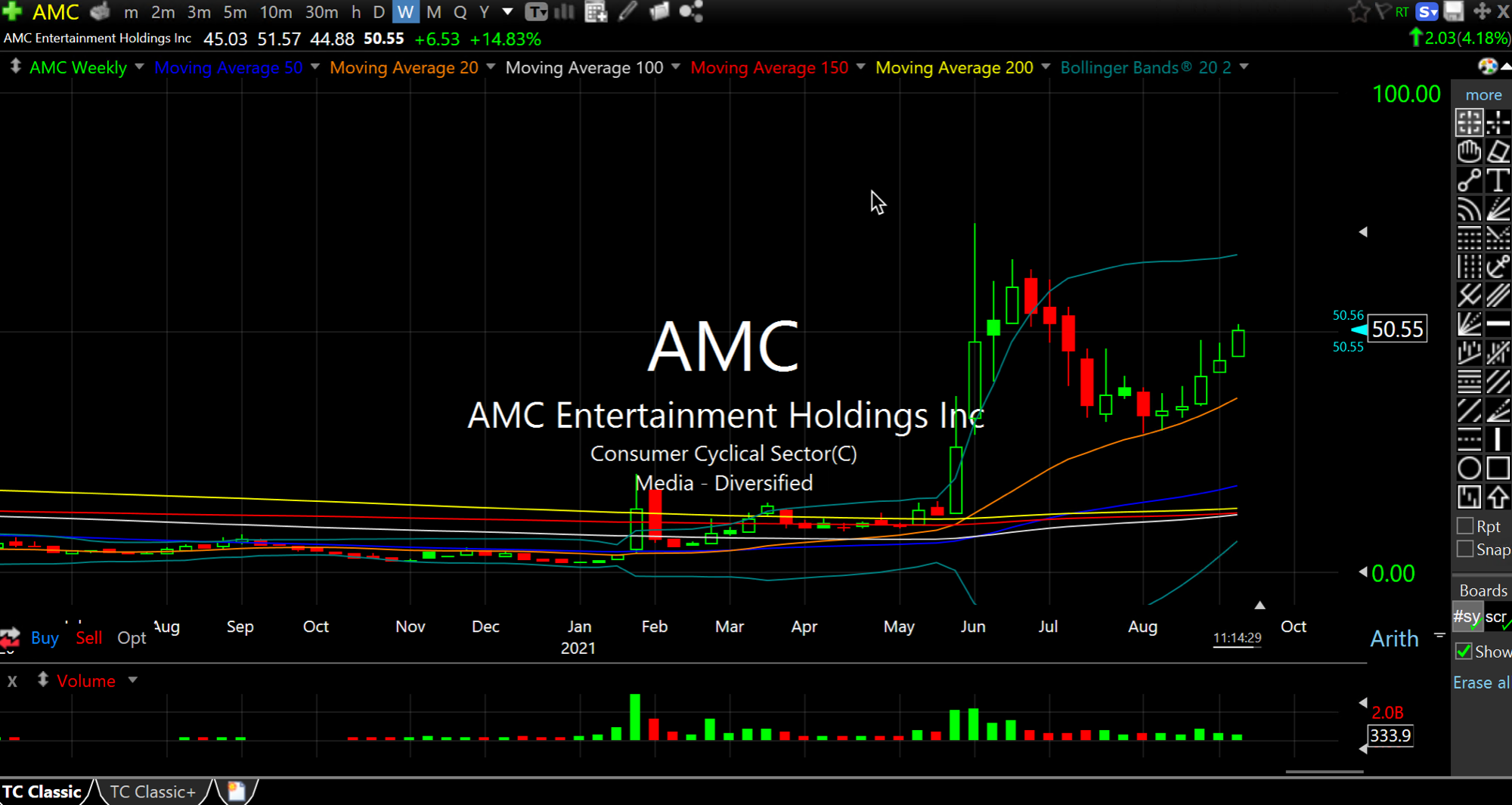

AMC, on the back of President Biden's speech, is acting like the Delta variant is closer to the end of its own movie than the beginning. It remains both a heavily-shorted name with a strong chart on all timeframes, the weekly one first below. It is tough to see how shorts can be comfortable in this name, as the risk of another fast move up still seems high.

For better short ideas, MA (daily chart, second below) and Visa both look like bear flags within ongoing corrections for them.

Overall, bears succeeded in a morning fade another green open. However, just as was the case yesterday, they need to take down the mega cap tech/FANG monsters in order to truly wreak havoc.