29Sep10:35 amEST

I'll Be Your Banker for Worthless Fiat

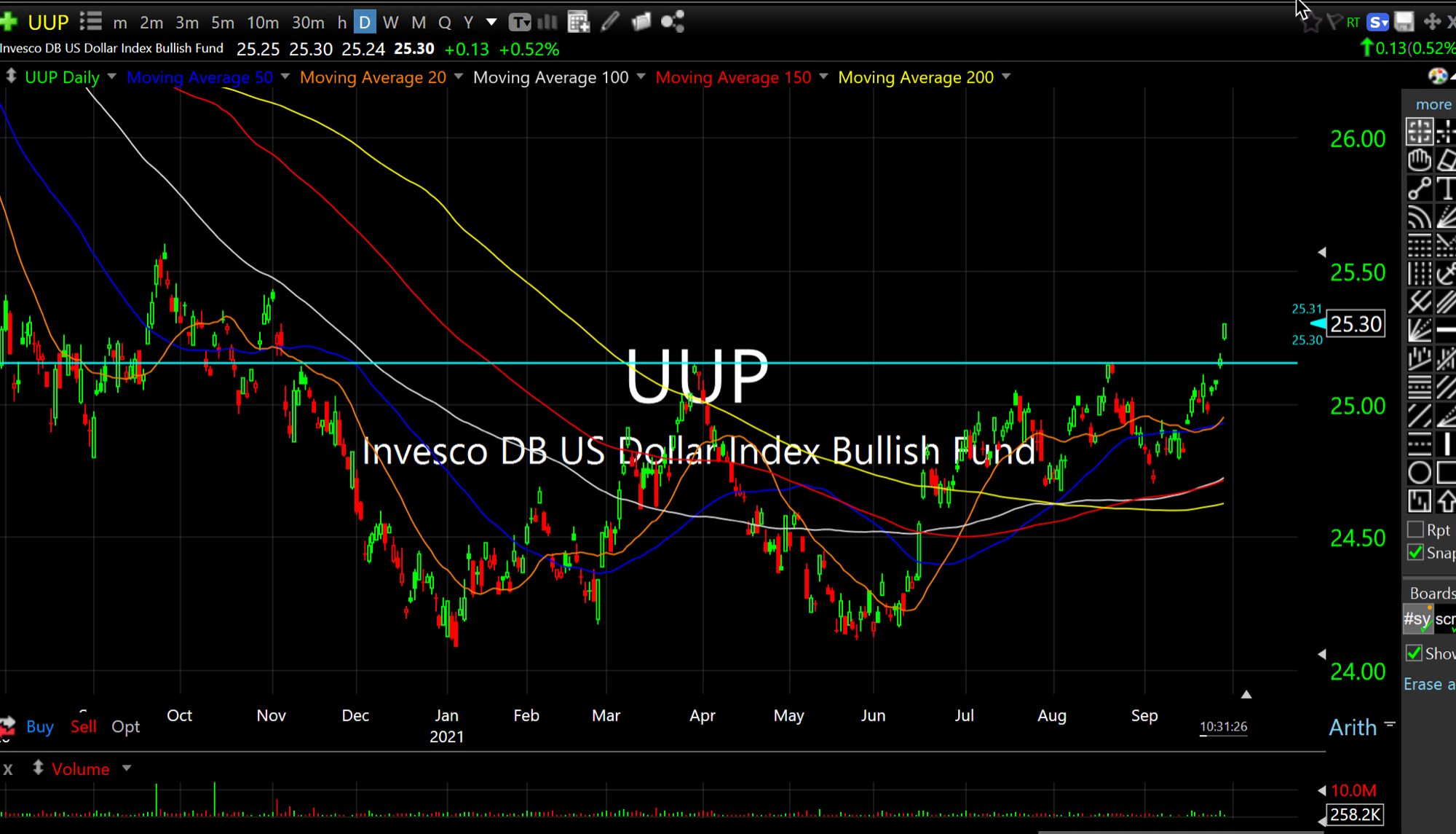

The U.S. Dollar, gauged below by the UUP ETF (which pairs the Dollar versus a basket of developed economies' currencies) is printing multi-quarter highs this morning. And while there is not always an exact inverse relationship with precious metals and miners, I think it is fair to say that seeing silver dive lower here means that gold bugs are not exactly being helped by the greenback's furious ascent.

As for crypto, Bitcoin seems to be sleepwalking of late, perhaps waiting for the next natural directional move to materialize. But seeing the recent commodity strength in natty, crude, and assorted other ones alongside the Dollar strength may seem puzzling to many--After all, in inflation shouldn't see the Dollar crash and commodities, including gold/silver, moon shot? The answer is likely yes, but the sequence of those events can often seem random, at best. Another factor to consider is the inflation around the word, with the demand for Dollars present for a variety of mechanical reasons.

Overall, the Dollar strength for most traders should only be noted if you are trading this particular market, and perhaps as an inverse gauge to gold/silver. But unless this is in your wheelhouse, it is likely not getting too hung up on it yet. Specifically, if you are looking (like I am) to re-buy natural gas on this dip or pause, I am not going to focus much on what the Dollar is doing.

Elsewhere, we have a mixed bounce in equites this morning. Note that ARKK is still relatively and absolutely weak, which I take as another sign that growth stocks are undergoing a more serious correction than many seem to want to acknowledge...at least not yet.